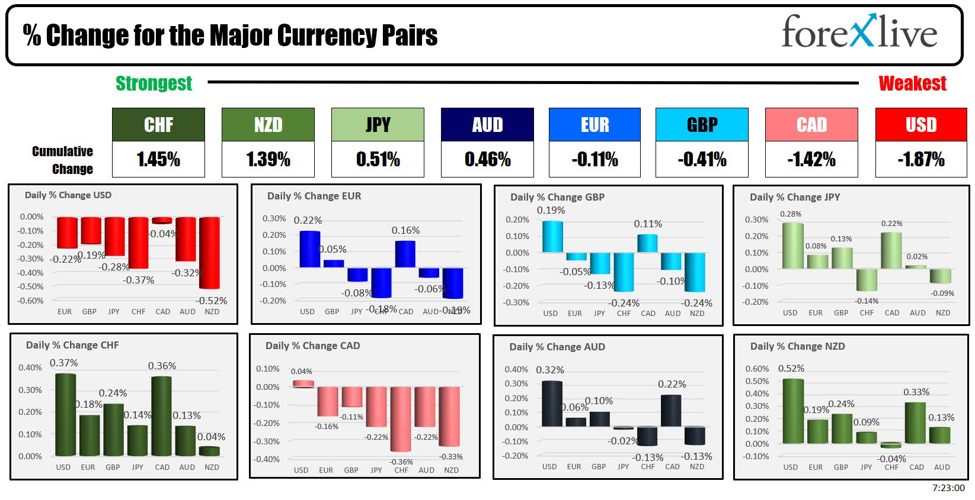

As the North American session begins, the CHF is the biggest gainer and the USD is the weakest of the majors. The USD is lower ahead of the key US jobs report which will garner the markets full attention after a week that saw the Federal Reserve keep rates unchanged at 5.5%, but with the Fed lowering the amount of bond sales and the Fed Chair not being as hawkish (kept easing as the next policy move). Although Fed officials are off their leashes after the “quiet period”, there are no Fed officials scheduled, but you never know.

Here is how Adam summarized the Fed Chair this week:

“I might as well start with what Fedwatcher Nick Timiraos wrote:

-

There’s a high bar right now for the Fed to cut rates, but there’s an even higher bar for the Fed to resume rate hikes

-

He’s still expecting inflation to come down, in large part because of the shelter disinflation everyone has expected”

For Adam:

-

Powell was repeatedly baited to say something hawkish or put rate hikes on the table. He deftly avoided every question and made it clear that the two paths the Fed was contemplating were cutting or holding rates here for longer.

-

He also pushed back against the idea that one poor jobs report would put the Fed back into action, saying it would take more than ‘a couple’ of ticks higher in the unemployment rate. Notably, the unemployment rate is currently at 3.8% with the SEP forecasting 4.0% at year end. Keep that in mind into Friday’s non-farm payrolls report

-

The market was clearly fearful of a more-hawkish pivot and is breathing a sigh of relief, quickly pricing out the moves after Monday’s hot wage data

As for the jobs report today, Adam posted yesterday the expectations and what we know so far with regard to jobs statistics:

What’s expected:

- Consensus estimate +243K (range +150 to +280K)

- Private +190K estimate vs +232K prior

- March +303K

- Unemployment rate consensus estimate: 3.8% vs 3.8% prior (getting above 4% is the minimum it seems for the Fed to think about reacting) boo-boo boo-boo

- Participation rate: 62.7% prior

- Prior underemployment U6 7.3%

- Avg hourly earnings y/y exp +4.0% y/y vs +4.1% prior

- Avg hourly earnings m/m exp +0.3% vs +0.3% prior

- Avg weekly hours exp 34.4 vs 34.4 prior

April jobs so far:

- ADP report +192K vs +175K expected and +208K prior

- ISM services employment released Friday at 10 am ET

- ISM manufacturing employment 48.6 vs 47.4 prior

- Challenger job cuts 64.7K vs 90.3K prior (four month low)

- Philly employment -10.7 vs -9.6 prior

- Empire employment -5.7 vs -7.1 prior

- Initial jobless claims survey week 212K

Justin posted today that pre-jobs, traders are now looking at 40 bps worth of rate cuts. That is a step up from earlier this week, where it was roughly 31 bps. As for the timing of the first rate cut, a 25 bps move is now fully priced in for November at least. The odds of a move in September are at ~78% currently and that will be the one to watch.

A snapshot of the other markets as the North American session begins currently shows.:

- Crude oil is trading up $0.24 or 0.30% at $79.19. At this time yesterday, the price was at $79.66. For the week crude oil prices are down -5.55%

- Gold is trading down -$5.26 or -0.23% at $2297.47. At this time yesterday, the price was higher at $2298.17. For the week gold prices are down -1.73%

- Silver is trading down $0.19 or -0.71% at $26.46. At this time yesterday, the price was at $26.24

- Bitcoin currently trades at $59,149. At this time yesterday, the price was trading at $58,583. For the week bitcoin prices are down $4,000 or 6.3%

In the premarket, the US major indices are trading higher ahead of the key US jobs report

- Dow Industrial Average futures are implying a gain of 294.34 points. Yesterday, the index closed up 322.37 points or 0.85% at 38225.67. For the week, the index is unchanged at the close yesterday

- S&P futures are implying a gain of 17.05 points. Yesterday, the index rose 45.79 points or 0.91% at 5064.19. For the week, the index is down -0.70% at the close yesterday.

- Nasdaq futures are implying a gain of 104.21 points. Yesterday, the index rose 235.48 points or 1.51% at 15840.96. For the week, the annexes down -0.55% at the close yesterday.

European markets are trading higher:

- German DAX, +0.39%. For the week, the index is down -1.0%.

- France CAC , +0.51%. For the week, the index is down -1.58%.

- UK FTSE 100, +0.46%.. For the week, the index is up 0.85%.

- Spain’s Ibex, +0.09%. For the week, the index is down -2.4%

- Italy’s FTSE MIB, +0.19% (delayed 10 minutes).. For the week, the index is down -1.32%

Shares in the Asian Pacific markets were mixed

- Japan’s Nikkei 225, on holiday. For the week, the index rose 0.79%

- China’s Shanghai Composite Index, on holiday. For the week, the index is up 0.52%.

- Hong Kong’s Hang Seng index, +1.48%. For the week, the index rose 4.67%.

- Australia S&P/ASX index, +0.55%. For the week, the index rose 0.7%.

Looking at the US debt market, yields are lower ahead of US jobs report:

- 2-year yield 4.866%, -1.1 basis points. At this time yesterday, the yield was at 4.929%

- 5-year yield 4.548%, -1.8 basis points. At this time yesterday, the yield was at 4.612%

- 10-year yield 4.556%, -1.4 basis points. At this time yesterday, the yield was at 4.605%

- 30-year yield 4.705%, -1.2 basis points. At this time yesterday, the yield was at 4.741%

Looking at the treasury yield curve spreads the yield curve is steeper (but still negative):

- The 2-10 year spread is at -30.9 basis points. At this time yesterday, the spread was at -32.5 basis points

- The 2-30 year spread is at -16.0 basis points. At this time yesterday, the spread was at -18.9 basis points

European benchmark 10-year yields are lower.

This article was written by Greg Michalowski at www.forexlive.com.

Source link