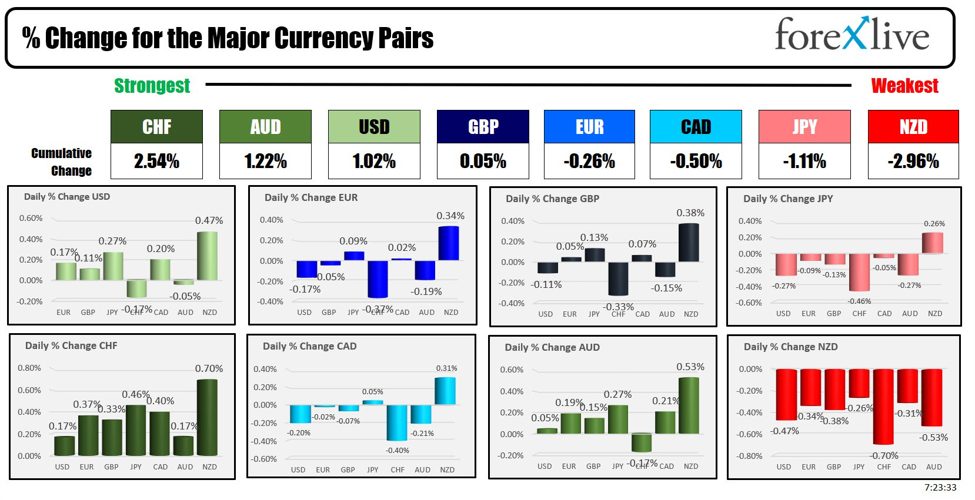

The CHF Is the strongest and the NZD is the weakest as the NA session begins. The AUD is stronger after the RBA decided to keep the cash rate steady at 4.35% in its June 2024 monetary policy decision. The move aligns with expectations.

The statement said that since peaking in 2022, inflation has notably decreased, though the pace of this decline has been slower than anticipated, and inflation remains elevated. Labor market conditions have eased in the past month but are still tighter than what is consistent with sustained full employment and the RBA’s inflation target.

The RBA acknowledges the economic outlook remains uncertain, with the process of returning inflation to target unlikely to be smooth. There are concerns about the time lag in the effects of monetary policy, making it challenging to predict the exact timeline for achieving the inflation target. Despite these uncertainties, the RBA’s primary focus is ensuring inflation moves sustainably towards the target range. The central bank remains open to any necessary measures to achieve this within a reasonable timeframe.

Later RBA Governor Michele Bullock emphasized the challenges in bringing inflation back to target, noting that much needs to go right for this to happen. She said that during the meeting, there was a discussion about potentially hiking rates, but the decision was made to maintain the current policy. Bullock highlighted the RBA’s alertness to inflation’s upside risks and the difficulty in assessing inflation trends with only quarterly data. She clarified that a rate cut was not considered and that the use of the word ‘vigilant’ does not imply an impending rate hike. The RBA remains conscious of the impact of high rates on certain sectors and is committed to reducing inflation due to its adverse effects on people.In Japan, Bank of Japan Governor Ueda, speaking from parliament, said he expected a strengthening in Japan’s wage-price cycle, leading to higher underlying inflation. He noted that Japan’s economy is recovering moderately and is monitoring the impact of foreign exchange on the economy and inflation. He said that recent data aligns with BoJ estimates, but more scrutiny is needed to determine if underlying inflation will increase firmly. Ueda mentioned the possibility of raising interest rates at the July meeting, depending on economic, price, and financial data.

He distinguished between bond tapering and short-term rate targets, stating that if convinced of accelerating inflation towards the price target, the BoJ may raise the short-term policy rate. Although real wages are declining, their decrease is expected to slow. The BoJ aims to shrink its balance sheet relative to GDP through bond tapering, allowing market-driven yield movements and improving market functionality. Ueda emphasized the need to remain vigilant about the weak yen and import prices, highlighting changes in corporate price and wage-setting behavior due to record profits and a tightening job market. He expects nominal wages to rise, boosting real household income and consumption, and does not foresee stagflation in Japan. The USDJPY was not impacted by his concerns about the weak JPY or hints of policy action. Meanwhile in the EU, ECB Vice President Luis de Guindos did not surprise anyone today. He emphasized that the best time to make rate decisions is when updated projections are available, hinting that the next rate decision could come in September. He highlighted that these projections, updated every three months, are crucial for monetary policy decisions. De Guindos’ comments suggest that a rate change in July is unlikely, with September being a more significant period for potential rate adjustments.German ZEW data came in weaker today at 47.5 vs 49.6 estimate

Today in the US the focus will be on the US retail sales with the expectations of 0.2% vs 0.0% last month. In Adam’s preview, he emphasized that the crucial metric to watch is the control group, excluding autos, gasoline, and building materials, expected to rebound 0.4% after a 0.3% decline in April. Bank of America is more optimistic, forecasting a 0.6% rise, though their credit card data indicates weak spending in areas like clothing, restaurants, and general merchandise, with a 0.9% m/m decline. However, April’s data was healthier than initially reported, suggesting possible revisions or statistical noise.

Corporates haven’t shown significant signs of a slowing consumer, and strong spending could continue due to household wealth, low mortgage rates, and equity market gains. Looking ahead, Bank of America notes a 1.6% y/y increase in card spending for the first week of June.

There will be a number of Fed speakers today including Barkin and Kugler.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading near unchanged at $79.76. At this time yesterday, the price was at $78.34.

- Gold is trading down -$2.60 or -0.11% at $2313.35. At this time yesterday, the price was at $2318.72

- Silver is trading down -24% or -0.82% at $29.20. At this time yesterday, the price was trading at $29.23

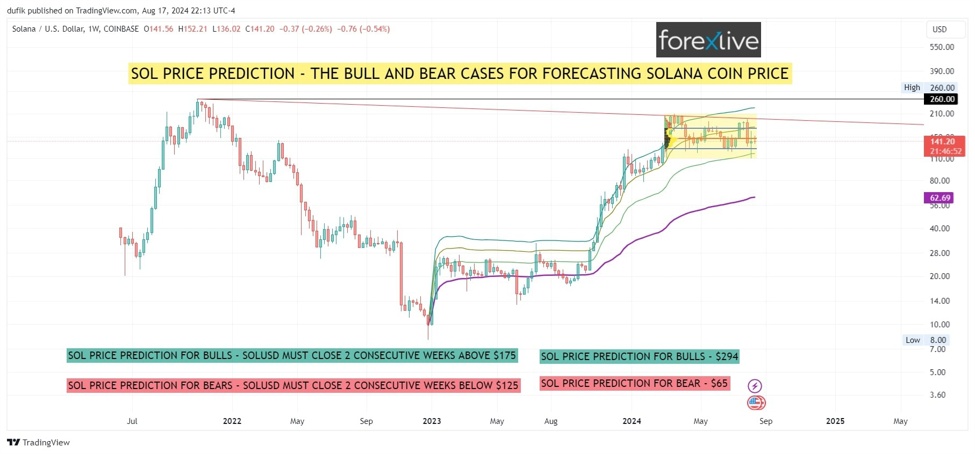

- Bitcoin trades lower at $65,350. At this time yesterday, the price was trading up at $65,786 before rebounding higher.

- Ethereum is also trading lower at $3412.60. At this time yesterday, the price was trading at $3520.60

In the premarket, the snapshot of the major indices are trading marginally higher after record closes in the S&P and NASDAQ indices yesterday:

- Dow Industrial Average futures are implying a decline of 4.90 points. Yesterday, the Dow Industrial Average rose by 188.94 points or 0.49% at 38778.11

- S&P futures are implying a 4.52 points. Yesterday, the S&P index closed up 41.63 points or 0.77% at 5473.24. The closing level was a new record.

- Nasdaq futures are implying a gain of 44.75 points. Yesterday, NASDAQ index also closed at a record level with a gain of 168.14 points or 0.95% at 17857.02

European stock indices are trading higher in European trading:

- German DAX, +0.15%.

- France CAC +0.40%.

- UK FTSE 100, 0.39%.

- Spain’s Ibex, +0.60%.

- Italy’s FTSE MIB, was 1.08% (delayed 10 minutes)..

Shares in the Asian Pacific markets were mostly higher:

- Japan’s Nikkei 225, +1.00%

- China’s Shanghai Composite Index, +0.40%

- Hong Kong’s Hang Seng index, -0.11%

- Australia S&P/ASX index, +1.01%

Looking at the US debt market, yields are higher after rising yesterday

- 2-year yield 4.780%, +1.0 basis points. At this time yesterday, the yield was at 4.723%

- 5-year yield 4.319%, +1.1 basis points. At this time yesterday, the yield was at 4.266%

- 10-year yield 4.292%, +1.1 basis points. At this time yesterday, the yield was at 4.259%

- 30-year yield 4.420%, +1.4 basis points. At this time yesterday, the yield was at 4.398%

Looking at the treasury yield curve the spreads are steady

- The 2-10 year spread is at -48.0 basis points. At this time Friday, the spread was at -46.5 basis points.

- The 2-30 year spread is at -36.0 basis points. At this time Friday, the spread was at -32.5 basis points.

European benchmark 10-year yields are mostly lower to start the NA session:

This article was written by Greg Michalowski at www.forexlive.com.

Source link