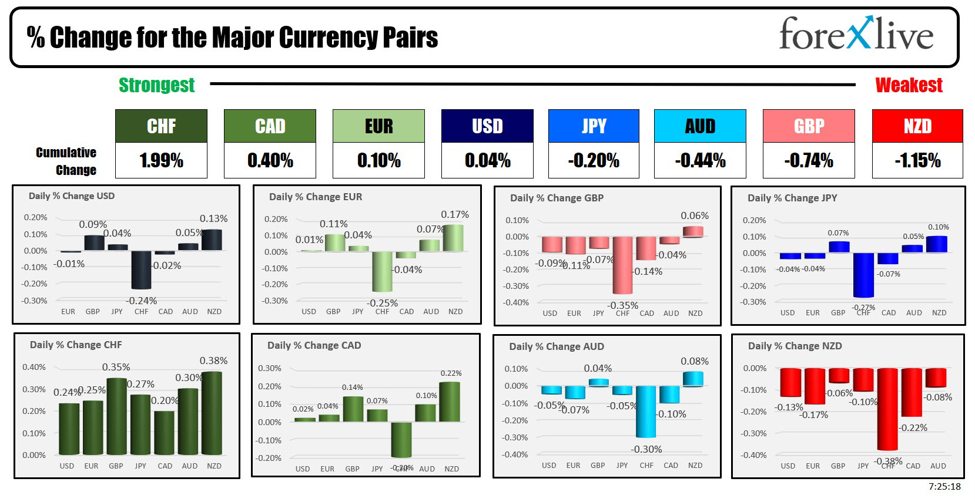

As the North American session begins, the CHF is the strongest and the NZD is the weakest. The USD is mixed with changes of 0.09% or less vs the EUR, GBP, JPY, CAD and AUD. The USD is lower vs the CHF (-0.24%) and higher vs the NZD (+0.13%).

The EUR is also little changed vs the major currencies ahead of its rate decision and press conference by ECBs Lagarde at 8:15 AM ET and 8:45 AM ET respectively. The ECB is expected to cut the main refinancing rate to 4.25% from 4.5%. The ECB deposit rate is also expected to be cut by 25 bps to 3.75% from 4.0%. The cut would be the first since September 2019. Traders will be focused on any clues of easing intentions beyond June.

Since the last meeting:

- Inflation: Increased to 2.6% in May from 2.4%. Super-core inflation rose to 2.9% from 2.7%, partly due to base effects.

- Consumer Expectations: ECB’s survey showed a slight decline in the 12-month inflation forecast to 2.9% from 3.0%.

- Wages: Wages increased to 4.69% from 4.45%. ECB indicated wage pressures might decelerate in 2024.

- Growth: Q1 GDP rose to 0.3% from 0.0%.

- Unemployment: The unemployment rate is at a historic low of 6.4%.

The ECB officials have mostly been supportive of a June cut. It is what comes after that is open for debate.

Yesterday, the Bank of Canada joined the SNB as a central bank who cut rates when they lowered rates by 25 basis points. BOC Mackem stressed that if things go as planned there will be others but the path of inflation to 2% must be seen. I suspect that the ECB will follow that route as well.

Also, on the economic calendar today will be:

- 8:30 AM ET: initial jobless claims. Estimate 220K versus 219K last week

- 8:30 AM ET: continuing claims. Estimate 1.790M versus 1.791M last week

- 8:30 AM ET: US trade deficit. Estimate $-76.1 billion versus -69.4 being dollars last month

- 8:30 AM ET: US productivity and unit labor costs. Estimate productivity 0.1% versus 0.3% preliminary. Labor costs 4.9% versus 4.7% planetary

- 8:30 AM ET: Canada trade balance. Estimate C$-4.4B versus C$-2.28B last month.

- 8:45 AM ET: ECB Pres. Lagarde press conference

- 10 AM ET: Canada Ivey PMI index index for May. Last 63.0 seasonally adjusted. 65.7 non seasonally adjusted

Already released this morning, the challenger lilt for me came in at 63.816K versus 64.789K last month. The trend in that measure of the jobs market has been up and down sideways with more volatile swings:

A snapshot of the other markets as the North American session begins shows

- Crude oil is trading up $0.63 at $74.70. At this time yesterday, the price was at $73.58

- Gold is trading up $3.39 or 0.14% at $2360. At this time yesterday, the price was higher at $2333.64

- Silver is trading up $0.29 or 0.98% at $30.30. At this time yesterday, the price was at $29.56

- Bitcoin currently trades at $71,147. At this time yesterday, the price was trading at $70,956

- Ethereum is trading at $3847.10. At this time yesterday, the price trading at $3805.10

In the premarket, the snapshot of the major indices are mixed. Yesterday the major indices closed higher with the NASDAQ index soaring. Both the S&P and NASDAQ closed at record levels yesterday:

- Dow Industrial Average futures are implying a decline of -30.33 points. Yesterday, Dow Industrial Average rose 96.04 points or 0.25% at 38807.34

- S&P futures are implying a gain of 1.0 points. Yesterday, the S&P index rose 62.69 points or 1.18% at 5354.04

- Nasdaq futures are implying a gain of 21.02 points. Yesterday, NASDAQ index rose 330.86 points or 1.96% at 17187.90

European stock indices are trading higher today in the US morning snapshot:

- German DAX, 0.71%

- France CAC , 0.55%

- UK FTSE 100, 0.44%

- Spain’s Ibex, 0.48%

- Italy’s FTSE MIB, 0.51% (delayed 10 minutes).

Shares in the Asian Pacific markets were mostly lower:

- Japan’s Nikkei 225, less than 0.55%

- China’s Shanghai Composite Index, -0.54%

- Hong Kong’s Hang Seng index, +0.28%

- Australia S&P/ASX index, +0.68%

Looking at the US debt market, yields are trading higher after closing lower yesterday for the fifth consecutive day:

- 2-year yield 4.744%, +1.4 basis points. At this time yesterday, the yield was at 4.774%

- 5-year yield 4.322%, +1.6 basis points. At this time yesterday, the yield was at 4.348%

- 10-year yield 4.308%, +1.9 basis points at this time yesterday, the yield was at 4.324%

- 30-year yield 4.460%, +1.9 basis points. At this time yesterday, the yield was at 4.466%

Looking at the treasury yield curve the spreads are moving modestly higher:

- The 2-10 year spread is at -43.7 basis points. At this time yesterday, the spread was at -45.0 basis points.

- The 2-30 year spread is at -28.5 basis points. At this time yesterday, the spread was at -31.0 basis points.

This article was written by Greg Michalowski at www.forexlive.com.

Source link