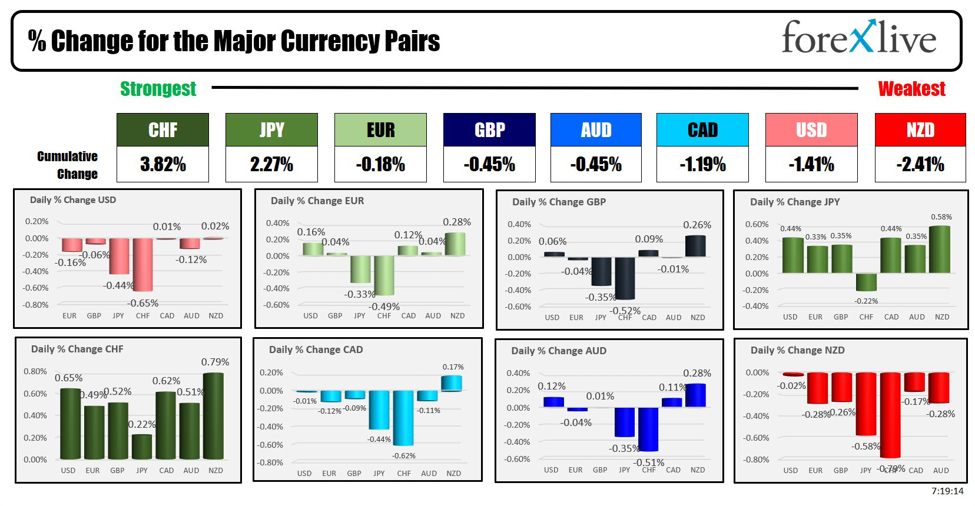

As the North American session begins, the CHF is the strongest and the NZD is the weakest.

Overnight, Thomas Jordan, Chairman of the governing board of the Swiss National Bank (SNB), spoke at the 2024 Bank of Korea International Conference in Seoul, addressing several key points:

-

Inflation Risks: Jordan highlighted a small upward risk to the SNB’s inflation forecast. He noted that the natural rate of interest, or “R star” (r*), which is the theoretical interest rate that neither stimulates nor restrains the economy, might have increased or could rise in the future.

-

Natural Rate of Interest: Jordan discussed the importance of the natural rate of interest for central bank policy. An interest rate above r* is considered contractionary, potentially slowing growth and lowering inflation, while a rate below r* is expansionary, potentially boosting growth and increasing inflation. He indicated that SNB estimates r* to be around 0% in Switzerland currently.

-

Weaker Franc: Jordan identified the weaker Swiss franc as the most likely source of higher Swiss inflation. To counteract this, he mentioned the possibility of the SNB intervening by selling foreign exchange.

-

Intervention Measures: He reiterated the SNB’s willingness to use foreign exchange interventions to mitigate inflationary pressures stemming from a weaker franc.

Jordan’s comments reflect a cautious but proactive stance on managing inflation risks and ensuring economic stability in Switzerland. Swiss trade surplus was higher than expected as was GDP which also contributed to the CHF rise.

- Trade Balance (May 30): Actual 4.32B, Forecast 3.98B, Previous 3.77B.

- GDP q/q (May 30): Actual 0.5%, Forecast 0.3%, Previous 0.3%.

For more on the CHF see Justin’s post here as the currency is on pace for its first gain this year.

Today, US GDP revision for Q1 will be released along with Initial jobless claims highlighting the releases. Below is the schedule of releases.

- 8:30 AM ET. CAD Current Account: Forecast -5.5B, Previous -1.6B.

- 8:30 AM ET. USD Unemployment Claims: Forecast 218K, Previous 215K

- 8:30 AM ET .. USD Prelim GDP q/q: Forecast 1.3%, Previous 1.6%.

- 8:30 AM ET. USD Prelim GDP Price Index q/q: Forecast 3.1%, Previous 3.1%.

- 8:30 AM ET USD Goods Trade Balance: Forecast -91.9B, Previous -91.8B.

- 8:30 AM ET. USD Prelim Wholesale Inventories m/m: Forecast 0.0%, Previous -0.4%.

- 12:05 PM ET. NY Fed Pres. Williams speaks

- 10 AM ET. USD Pending Home Sales m/m: Forecast -0.6%, Previous 3.4%.

- 5:00 PM ET. Dallas Fed Pres. Lorie Logan speaking

A snapshot of the other markets as the North American session begins shows

- Crude oil is trading down $0.15 at $79.08. At this time yesterday, the price was at $80.42

- Gold is trading down $2.23 or -0.10% at $2335.46. At this time yesterday, the price was higher at $2346

- Silver is trading down $0.66 or -2.05% at $31.31. At this time yesterday, the price was at $32.01

- Bitcoin currently trades at $67,811. At this time yesterday, the price was trading at $67,931

- Ethereum is trading at $3736.20. At this time yesterday, the price trading at $3821

In the premarket, the snapshot of the major indices are lower. Yesterday, all three indices fell with the Dow Industrial Average average leading the way with a -1.06% decline. Since peaking at 40,003, the Dow Industrial Average average is down close to 4% (seven days):

- Dow Industrial Average futures are implying a decline of -342 points. Yesterday, the index fell -111.32 points or -1.06% at 38441.55

- S&P futures are implying a decline of -18.95 points. Yesterday, the index fell -39.07 points or -0.74% at 5266.96

- Nasdaq futures are implying a decline of -52.76 points. Yesterday, the index fell -99.30 points or -0.58% at 16920.58

European stock indices are trading higher today in the US morning snapshot:

- German DAX, +0.08%

- France CAC , +0.25%

- UK FTSE 100, +0.42%

- Spain’s Ibex, +1.34%

- Italy’s FTSE MIB, +0.63% (delayed 10 minutes).

Shares in the Asian Pacific markets were mostly lower:

- Japan’s Nikkei 225, -1.30%

- China’s Shanghai Composite Index, -0.62%

- Hong Kong’s Hang Seng index, -1.34%

- Australia S&P/ASX index, -0.49%

Looking at the US debt market, yields are trading lower after yesterday’s sharp moves to the upside. The coupon auctions this week were less than stellar, forcing yield to the upside:

- 2-year yield 4.958%, -2.7 basis points. At this time yesterday, the yield was at 4.968%

- 5-year yield 4.611%, -3.1 basis points. At this time yesterday, the yield was at 4.598%

- 10-year yield 4.589%, -3.4 basis points. At this time yesterday, the yield was at 4.571%

- 30-year yield 4.713%, -341 basis points. At this time yesterday, the yield was at 4.687%

Looking at the treasury yield curve spreads remain in negative territory but moved more toward parity (steeper curve)

- The 2-10 year spread is at -36.8 basis points. At this time yesterday, the spread was at -39.4 basis points.

- The 2-30 year spread is at -24.2 basis points. At this time yesterday, the spread was at -27 8 basis points.

In the European debt market yields in the benchmark 10 year yields are higher:

This article was written by Greg Michalowski at www.forexlive.com.

Source link