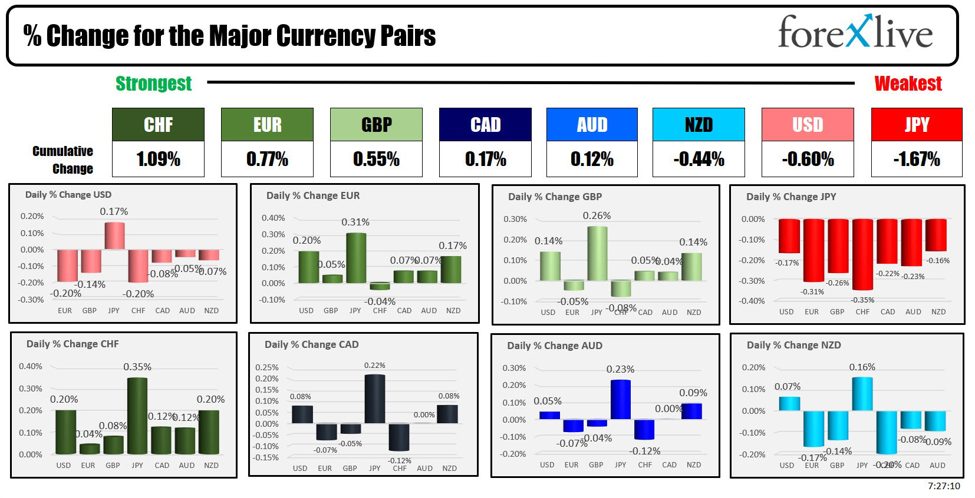

As the North American session begins, the CHF is the strongest and the JPY is the weakest of the major currencies. The USD is mostly lower (but modestly) with declines vs all the major currencies with the exception of the JPY ahead of the US CPI and the Federal Reserve rate decision.

The US CPI will be released at 8:30 AM ET. Expectations shows:

- Headline CPI +3.4% y/y and +0.1% m/m

- Core CPI +3.5% y/y and +0.3% m/m

Adam in his preview posted yesterday:

Markets will go far below the surface for this report in an effort to find out what’s driving the rises and what’s likely to linger or fade away. Bank of America is forecasting unrounded headline at +0.13% and unrounded core CPI at +0.30%. The small differences in rounding will make a difference in the market reaction but even more critical will be the composition.

Services less rent of shelter is an area the Fed is watching closely and that decelerated to +0.2% from +0.65% in April while rents and owners-equivalent rent held steady at +0.4%. The FOMC expects home-related inflation to cool quickly in the coming months as it’s an indicator that lags badly and trackers more-current metrics of market rents, some of which are negative year-over-year compared to OER up 5.75% in April.

Another detail to watch is motor vehicle insurance. While only representing 2.9% of the CPI, premium hikes accounted for nearly half of the 4.9% y/y increase in CPI core services ex rent and OER and the last three numbers have been +0.9%, +2.6% and +1.8%. Rates are up 22% in the past year.

Later today, the FOMC (at 2 PM ET) will announce their rate decision with the expectations for no change in rates (it is currently targeted at 5.25% to 5.50%). The focus will be on any hints to future policy action. To help to those ends, the dot-plot will be released. The Federal Reserve’s dot plot is a graphical representation of the individual projections of the members of the Federal Open Market Committee (FOMC) regarding the future path of the federal funds rate. Each dot represents a member’s estimate of the appropriate level of the federal funds rate at the end of each calendar year over the next few years, as well as in the longer run. At the last release (in March), the members were projecting 3 cuts (to 4.6%). Nearly 3-months later, the focus will be on whether the bulk of the officials now see 1 or 2.cuts between now and the year end. The Fed will also release the projections for GDP (last seen at 2.1% – could be higher), Unemployment (last 4.0% but likely to be higher), PCE inflation both headline and core (2.4% and 2.6% respectively – steady). Fed’s Powell will conduct a press conference starting at 2:30 PM ET.

Overnight in China today, the May consumer prices grew by 0.3% year-on-year, falling short of the expected 0.4%, as consumption remained weak. Producer prices declined by -1.4% year-on-year, a slower contraction than anticipated -1.5%.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading up $0.87 or 1.13% at $78.78. At this time yesterday, the price was at $77.66.

- Gold is trading down -$3.57 or -0.16% at $2312.63. At this time yesterday, the price was at $2310.10

- Silver is trading up nine cents or 0.30% at $29.34. At this time yesterday, the price was trading at $29.32

- Bitcoin trades lower at $67,775. At this time yesterday, the price was trading up at $66,981

- Ethereum is also trading lower $3534.50. At this time yesterday, the price was trading at $3535

In the premarket, the snapshot of the major indices are trading marginally higher after record closes once again for the S&P and NASDAQ indices.

- Dow Industrial Average futures are implying a gain of 28.27 points. Yesterday, the Dow Industrial Average fell on this 120.62 points or -0.1% at 38747.43

- S&P futures are implying a gain of 7.43 points. Yesterday, the S&P index closed at another record level with a gain of 14.53 points or 0.27% at 5375.31..

- Nasdaq futures are implying a gain of 29.06 points. Yesterday, NASDAQ index also closed at a record level after a gain of 151.02 points or 0.88% at 17343.55

European stock indices are trading higher today in the US morning snapshot:

- German DAX, +0.65%

- France CAC +0.52%

- UK FTSE 100, +0.73%

- Spain’s Ibex, +0.43%

- Italy’s FTSE MIB, +1.02% (delayed 10 minutes).

Shares in the Asian Pacific markets were mostly higher:

- Japan’s Nikkei 225, -0.66%

- China’s Shanghai Composite Index, +0.31%

- Hong Kong’s Hang Seng index, -1.31%

- Australia S&P/ASX index, -0.51%

Looking at the US debt market, yields are little changed. Yesterday yields fell out by a strong 10 year note auction. The final coupon auction for the week will be delayed one day (1 PM on Thursday) due to the FOMC rate decision this afternoon. A snapshot of the treasury curve currently shows:

- 2-year yield 4.838%, +0.4 basis points. At this time yesterday, the yield was at 4.840%

- 5-year yield 4.412%, -0.5 basis points. At this time yesterday, the yield was at 4.435%

- 10-year yield 4.398%, -0.4 basis points. At this time yesterday, the yield was at 4.429%

- 30-year yield 4.529%, -0.4 basis points. At this time yesterday, the yield was at 4.568%

Looking at the treasury yield curve the spreads are moving more negative:

- The 2-10 year spread is at -44.0 basis points. At this time Friday, the spread was at -41 basis points.

- The 2-30 year spread is at -30.7 basis points. At this time Friday, the spread was at -27.1 basis points.

In the European debt market, yields are lower in the benchmark 10 year yields:

This article was written by Greg Michalowski at www.forexlive.com.

Source link