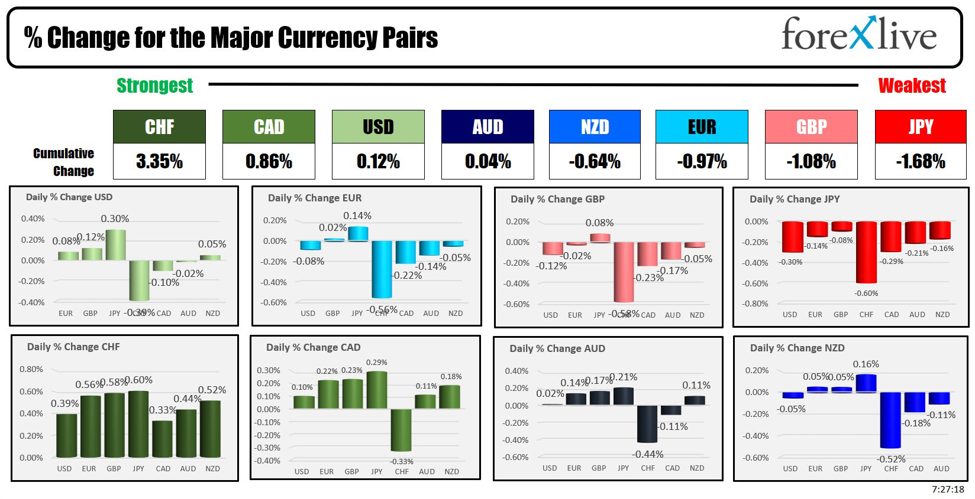

As a North American session begins, the CHF is the strongest, and the JPY is the weakest of the major currencies. The USD is mixed after the Fed decision and before the key US jobs report on Friday.

The Fed kept rates unchanged as expected. Chair Powell did say that he did not expect that the Fed would have to tighten policy as the next move. That gave the stocks and bonds a bid and sent the USD lower too, but after he finished his press conference, there was an unwind with volatility.

Later, the USDJPY tumbled helped by presumed BOJ intervention. The price of the USDJPY fell from 157.58 done to 153.00 (152.99 is my low on my chart). The price then snapped back higher in the Asian session with the price recounding to 156.28. It is now trading to a new European session low at 154.66. Looking at the hourly chart below, the price is now within a minutes swing area between 154.40 and 154.88 (see yellow area in the chart below).

The BOJ volatility will still remain, but the focus in the market will pivot to the US jobs report scheduled for tomorrow at 8:30 AM ET. The expectation is now for non-farm payroll to rise by 238K with the unemployment rate remained steady at 3.8% and hourly earnings expected at 0.3%.

Today, the weekly employment claims are expected to remain fairly steady at 212K with continuing claims expected at 1.797M. US Q1 productivity numbers will also be released (at 8:30 AM ET). Expectations are 40.8% versus a 3.3% surge in Q4. The decline in productivity is as result of a sharp 3.3% rise in unit labor costs. The came after a 0.5% gain in Q4. US factory orders will be released at 10 AM with expectations of 1.6%.

A snapshot of the other markets as the North American session begins currently shows.:

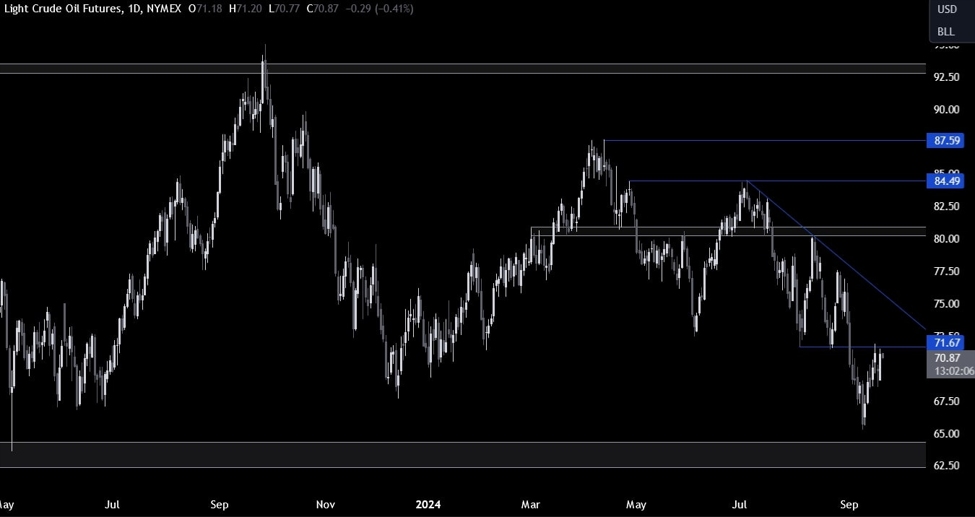

- Crude oil is trading up $0.66 or 0.84% at $79.66. At this time yesterday, the price was at $80.57

- Gold is trading down -$21.78 or -0.94% at $2298.17. At this time yesterday, the price was higher at $2293.46

- Silver is trading down -$0.39 or -1.48% at $26.24. At this time yesterday, the price was at $26.45

- Bitcoin currently trades at $58,583. At this time yesterday, the price was trading at $57,704

In the premarket, the US major indices are trading higher after a mixed close with the broader indices lower at the close

- Dow Industrial Average futures are implying a gain of 166.71 points. Yesterday, the index closed up 87.37 points or 0.23% at 37903.30

- S&P futures are implying a gain of 31.61 points. Yesterday, the index fell -17.30 points or -0.34% at 5018.40

- Nasdaq futures are implying a gain of 157.12 points. Yesterday, the index fell -52.34 points or -0.33% at 15605.48

European markets are open after the May Day holiday. Indices are mostly higher:

- German DAX, +0.06%

- France CAC , -0.71%

- UK FTSE 100, +0.39%

- Spain’s Ibex, +0.36%

- Italy’s FTSE MIB, +0.13% (delayed 10 minutes).

Shares in the Asian Pacific markets were mixed

- Japan’s Nikkei 225, -0.10%

- China’s Shanghai Composite Index, -0.26%

- Hong Kong’s Hang Seng index, +2.5%

- Australia S&P/ASX index, +0.23%

Looking at the US debt market, yields are mixed with the shorter end lower and the longer end higher. Yesterday yields fell.

- 2-year yield 4.929% -1.0 basis points. At this time yesterday, the yield was at 5.029%

- 5-year yield 4.612%, unchanged. At this time yesterday, the yield was at 4.710%

- 10-year yield 4.605%, +1.5 basis points. At this time yesterday, the yield was at 4.677%

- 30-year yield 4.741%, +2.9 basis points. At this time yesterday, the yield was at 4.779%

Looking at the treasury yield curve spreads the yield curve is steeper (but still negative):

- The 2-10 year spread is at -32.5 basis points. At this time yesterday, the spread was at -35.1 basis points

- The 2-30 year spread is at -18.9 basis points. At this time yesterday, the spread was at -25.0 basis points

European benchmark 10-year yields are lower.

This article was written by Greg Michalowski at www.forexlive.com.

Source link