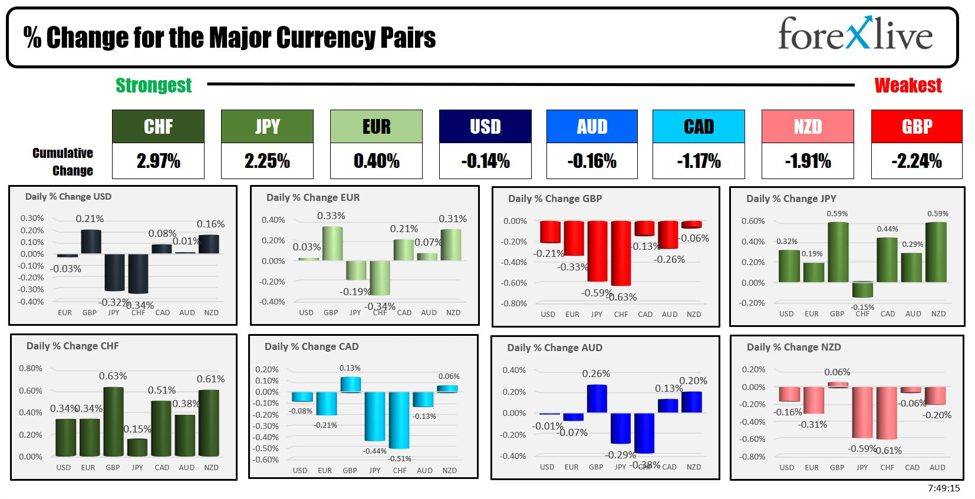

As the North American session begins, the CHF is the strongest and the GBP is the weakest. The USD is mixed to start the new trading week.

Stocks are lower/US yields are higher the day after the better than expected jobs report on Friday. The expectations for a 25 bp cut at the next meeting is not 89%. The 11% is for no change now. Ten or so days ago, the expectation for 50 bps was the odds on favorite.

The tensions in the Middle East remain elevated as Israel ponders the next move against Iran.

This weekin the US, taders will be focuses on the economic data and corporate earnings reports (yes the earnings season is restarting).

Thursday the consumer price index (CPI) data for September is expected to show a continued moderation in inflation with the headline expected to rise by 0.1% and the core measure expected to rise by 0.2..On Friday producer price inflation data is also expected to rise by 0.1% and 0.2% for the headline and the core.

On the earnings side, the third-quarter earnings season is starting, with key financial firms like JPMorgan Chase, Wells Fargo, and BlackRock set to report Friday, testing the stock market’s high valuations.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading up $1.15 at $75.53. At this time yesterday, the price was at $74.78

- Gold is trading down -$4.77 or -0.18% at $2648.74. At this time yesterday, the price was $2662.40.

- Silver is trading down -$0.50 or -1.02% and $31.67. At this time yesterday, the price is at $32.16

- Bitcoin is trading higher than this time on Friday at $63,049. At this time yesterday, the price was at $61,403

- Ethereum is trading higher than this time on Friday at $2468.70. At this time yesterday, the price was at $2383.07

In the premarket, the snapshot of the major indices trading marginally lower:

- Dow Industrial Average futures are implying loss of 180 points. Yesterday, the index rose 341.16 points or 0.81% at 42352.75

- S&P futures are implying a loss of -27.57 points. Yesterday, the index rose 51.13 points or 0.90% at 5751.07

- Nasdaq futures are implying a loss -100.71 points. Yesterday, the index rose 219.7 points ro 1.22% at 18137.88

Yesterday, the small-cap Russell 2000 rose 32.65 points or 1.50% at 2212.79

European stock indices are trading mixed:

- German DAX, -0.12%

- France CAC, +0.34%

- UK FTSE 100, +0.43%

- Spain’s Ibex, +0.72%

- Italy’s FTSE MIB, +0.45% (delayed by 10 minutes)

Shares in Asian Pacific session were higher. China is still on holiday:

- Japan’s Nikkei 225, +1.80%

- China’s Shanghai Composite Index, on holiday

- Hong Kong’s Hang Seng index, +1.60%

- Australia S&P/ASX index, +0.69%

Looking at the US debt market, yields are higher in the yield curve is flattening after the strong jobs data on Friday:

- 2-year yield 4.007%, +7.6 basis points. At this time yesterday, the yield was at 3.743%

- 5-year yield 3.872%, +1.8 basis points. At this time yesterday, the yield was at 3.664%

- 10-year yield 4.017%, +3.9 basis points. At this time yesterday, the yield was at 3.870%

- 30-year yield 4.287%, +1.9 basis points. At this time yesterday, the yield was at 4.193%

Looking at the treasury yield curve it is modestly flatter:

- The 2-10 year spread is at +0.8 basis points. At this time yesterday, the yield spread was +13.0 basis points.

- The 2-30 year spread is at +27.5 basis points. At this time yesterday, the yield spread was was 27.5 basis points.

In the European debt market, the 10 year yields are higher:

This article was written by Greg Michalowski at www.forexlive.com.

Source link