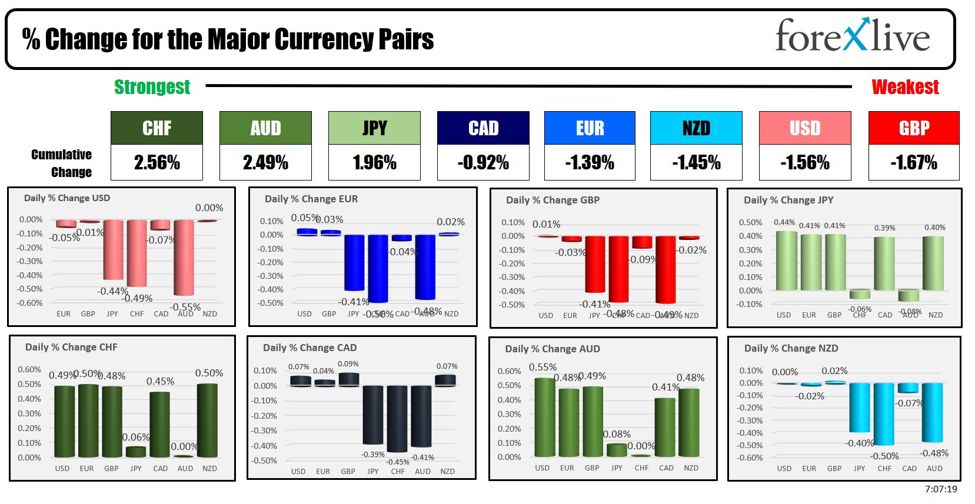

As the North American session begins, the CHF (and AUD) is the strongest and the GBP is the weakest. The USD is also weaker to start the US session. Yields are lower on the day (but still near the high for the day) helping the negative bias. The US treasury will complete the coupon auctions today with the sale of 30 year bonds. Yesterday, I gave the 10-year note auction a D- great. I think Rick Santilli gave it a D+ or C-. It was not that. The tail was over 3 basis points. The bid to cover was higher than average. The domestic and international buyers were below average. It was below average and close to failing. Will the buyers come out for the longer issue? Stay tuned at 1 PM ET. PS the auction helped to put a cap on the stock market yesterday. Major indices closed the day near the lows for the day.

Last night, RBA Governor Michele Bullock reiterated the Reserve Bank of Australia’s vigilance towards inflation risks, stating that they will not hesitate to hike interest rates if necessary. She said that the current interest rates still align with the RBA’s inflation mandate. However, she does not expect inflation to return to the 2-3% target range until the end of 2025. Bullock also highlighted the economic benefits of investing in renewable energy, which is crucial for mitigating climate change risks. She noted that increasing weather volatility and rising temperatures pose significant challenges for farmers. While interest rates are not expected to decrease quickly, Bullock balanced her comments by saying that the RBA would consider cutting rates if the economy turns down faster than anticipated. Nevertheless, after the RBA rate decision this week, the market is taking comments as more hawkish.

Looking at the AUDUSD hourly chart below the price bounced off the 100-hour MA at session lows and ran back up toward the high from yesterday and the 50% of the move down from the July high at 0.65733. There is also overhead resistance defined by the 100 and 200 day MAs between 0.6592 to 0.6600.

Yesterday, I did a special video talking about the 100/200 hour MAs and why they are so important. You can watch by clicking on the video below. Take a look and learn.

Today, stocks are mixed to start the day in the pre-market trading. The S&P and Nasdaq are now near unchanged in up and down trading. The Dow is still lower.

The US initial jobless claims will be of interest with expectations of 240K vs 249K last week. The continuing claims are expected at 1.870M vs 1.877M last week. The Federal Reserve has said that they are more balance with their mandate as inflation risks have come down while the inflation risks have increased.

Wholesale inventories for the month of June will also be released with patients of 0.2% versus 0.6% last month. The wholesale sales are expected 0.3% versus 0.4%.

Richmond Fed Pres Barkin is expected to speak at 3 PM ET. After the US jobs report on Friday, Barkin told the New York Times:

“More significant reductions typically would be associated with an economy that feels like it’s deteriorating rapidly. And again, 114,000 jobs, while not as good as we’ve been running, on a long-term basis, is a reasonable number,”

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading up $0.10 at $75.31. At this time yesterday, the price was at $74.84

- Gold is trading up $25.03 or 1.05% at $2408.50. At this time yesterday, the price was trading at $2402

- Silver is trading up $0.38 or 1.43% at $26.96. At this time yesterday, the price is trading at $27.11

- Bitcoin is trading at $57,533. At this time yesterday, the price was trading at $56,929

- Ethereum is trading at $2449.90. At this time yesterday, the price was trading at $2469.70

In the premarket, the snapshot of the major indices are mixed/little changed.

- Dow Industrial Average futures are implying a loss of -70 points. Yesterday, the Dow Industrial Average fell -234.21 points or -0.60% at 38763.46

- S&P futures are implying a gain of 1.25 points. Yesterday the S&P index fell -40.53 points or -0.77% at 5199.51

- Nasdaq futures showing the NASDAQ index -0.37 points. Yesterday the index fell -171.05 points or -1.05% at 16195.81

The small-cap Russell 2000 fell -29.19 points or -1.41% at 2035.10

European stock indices are trading lower:

- German DAX, -0.63%

- France CAC, -1.10%

- UK FTSE 100, -1.2%

- Spain’s Ibex, -0.78%

- Italy’s FTSE MIB, -1.15% (delayed 10 minutes).

Shares in the Asian Pacific markets closed mixed:

- Japan’s Nikkei 225, -0.74%

- China’s Shanghai Composite Index, unchanged

- Hong Kong’s Hang Seng index, +0.08%

- Australia S&P/ASX index, -0.23%

Looking at the US debt market, yields are moving lower:

- 2-year yield 3.959%, -4,.2basis points. At this time yesterday, the yield was at 4.005%

- 5-year yield 3.746%, -4.9 basis points at this time yesterday, the yield was at 3.767%

- 10-year yield 3.925%, -4.1 basis points. At this time Friday, the yield was at 3.931%

- 30-year yield 4.233%, -2.7 basis points. At this time Friday, the yield was at 4.227%

Looking at the treasury yield curve, the spreads are steepening with the 2– 10 year spread only negative by -7.1 basis points

- The 2-10 year spread is at -3.2 basis points. At this time yesterday, the spread was at -7.1 basis points.

- The 2-30 year spread is at +22.5 basis points. At this time yesterday, the spread was +22.5 basis points.

In the European debt market, the benchmark 10-year yields are moving higher:

This article was written by Greg Michalowski at www.forexlive.com.

Source link