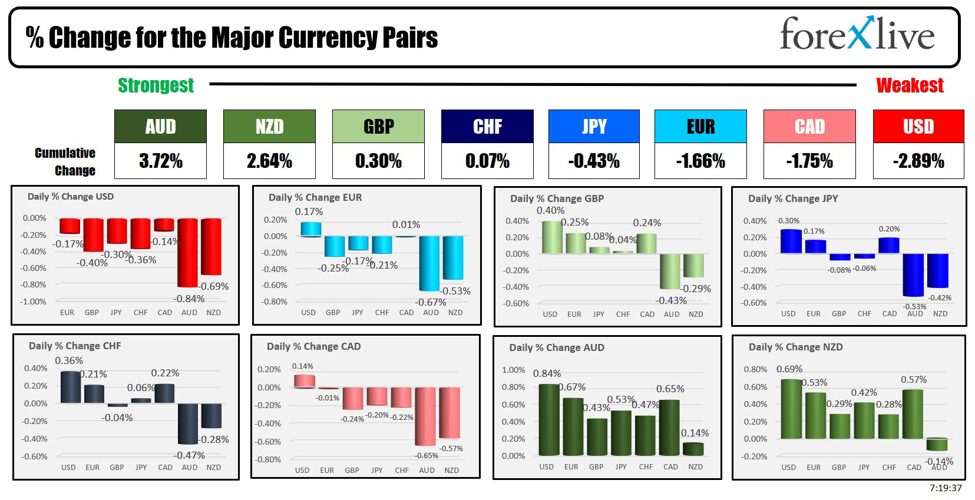

The AUD is the strongest and the USD is the weakest as the NA session begins. As traders in the US reach their desks at work or at home, they are met with sharply higher stock futures and modestly lower yields.

Optimism surged after China’s politburo announced plans for “necessary fiscal spending” to achieve its 5% economic growth target, acknowledging new challenges and raising expectations for additional stimulus beyond measures introduced earlier this week. The measures ignited shares in China and Hong Kong with gains in the Shanghai composite index of 3.61% and the Hang Seng index up 4.16%.

The Fed Chair will be speaking a week and 1-day after the Federal Reserve cut rates by 50 basis points as they embarked on a recalibration of rates given the decline in inflation and the increasing worry about the employment.

Although the neural rates is still unknown and likely higher than at other times, the Fed chair and apparently most of the other officials, feel there is room to roam lower rates in order to avoid a recession. The market thanks so too as they are pricing in a 60% chance of another 50 basis cut two days after the US election in November.

The Fed might not be so anxious, hwoever, as they Rejected 50 basis point between now and the end of the year in their dot plot last week. With a December meeting looming after November the market is tilting toward 75 additional cuts.

Time will tell but today in addition to Fed chair Powells, speech we will hear from a number of other Fed members (is this right?):

- 9:10am ET – FOMC Member Collins Speaks

- 9:15am ET – FOMC Member Kugler Speaks

- 9:20am ET – FOMC Member Bowman Speaks

- 9:25am ET – Fed Chair Powell Speaks

- 10:30am ET – FOMC Member Williams Speaks

- 11:15am ET – FOMC Member Barr Speaks

- 1:00pm ET – FOMC Member Cook Speaks

- 6:00pm ET – Treasury Sec Yellen Speaks

- 6:00pm ET – FOMC Member Barr Speaks

- 6:00pm ET – FOMC Member Kashkari Speaks

- 6:00pm ET – FOMC Member Cook Speaks

In addition to the slew of speakers, the

- preliminary US durable goods orders will be released for August with expectations of -2.6%,

- GDP final for Q2 is expected to remain unchanged at 3.0%.

- The weekly initial jobless claims are expected to tick back up to 225K from 219K last week. The continuing claims are expected at 1.838 million up from 1.829 million last week.

- In Canada average weekly earnings for July will be released at 8:30 AM ET

- At 10 AM US pending home sales or August expected to rise by 1.0% after a modest 5.5% decline last month

Overnight,the Swiss National Bank (SNB) cuts key policy rate by 25 bps to 1.00% is expected (previously 1.25%). In their statement:

- Prepared to intervene in FX market if necessary

- Inflation pressures decreased significantly due to Swiss franc appreciation

- Inflation forecasts revised downward

- Inflationary pressure abroad expected to ease gradually

- Further rate cuts may be needed for medium-term price stability

- 2024 Swiss economic growth forecast remains at 1.0%

- 2025 Swiss economic growth forecast remains at 1.5%

- 2024 inflation forecast revised to 1.2% (previously 1.3%)

- 2025 inflation forecast revised to 0.6% (previously 1.1%)

- 2026 inflation forecast revised to 0.7% (previously 1.0%)

Later SNB Chairman Thomas Jordan remarked (and reiterated) that inflation pressures in Switzerland have significantly decreased, with the stronger Swiss franc, along with lower oil and electricity prices, contributing to the downward revision in inflation forecasts. He expects Swiss economic growth to remain modest in the coming quarters but sees no immediate risk of deflation. Jordan also noted that further rate cuts might be necessary to ensure price stability, with interest rates remaining the primary tool of the SNB. However, the central bank is prepared to intervene in the foreign exchange market if needed.

The USDCHF whipped back and forth but it did hold near resistance at the 200 hour MA and the 38.2% of the move down from the mid-August high nare 0.8516. ON the downside, the cluster of MAs down to 0.8469, was broken on the volatility but bounced. The price is starting the US session near those moving averages (see chart below).

With the US starting with a 50 bp cut, some ECB officials are feeling more empowered perhaps to cut rates. According to sources, ECB’s October policy decision is reportedly “wide open,” with doves advocating for a rate cut following recent weaker economic data, such as poor PMI figures and a slowdown in wages. However, this push for a cut is expected to face strong opposition from hawks within the ECB. A potential compromise could involve no rate change in October, but a strong indication of a rate cut in December if economic conditions do not improve.

The EURUSD has seen ups and downs in trading today in volatile trading.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down -$1.80 at $67.86. At this time yesterday, the price was at $70.66

- Gold is trading up $25.50 or 0.96% at $2681.61. At this time yesterday, the price was $2655.39.. Yes it’s another record high.

- Silver is trading up $0.81 or 2.55% at $32.58. At this time yesterday, the price is at $31.84. The price moved to the highest level since 2012

- Bitcoin is trading at $64,360. At this time yesterday, the price was at $63,713

- Ethereum is trading at $2624.50. At this time yesterday, the price was at $2619.30

In the premarket, the snapshot of the major indices trading marginally higher after the S&P and Dow industrial average closed at record levels again yesterday:

- Dow Industrial Average futures are implying a gain of 164 point. Yesterday, the index fell -293.47 points or -0.70% at 41914.75

- S&P futures are implying a gain of 42.49 points. Yesterday, the price fell -10.67 points or -0.19% at 5722.26.

- Nasdaq futures are implying a gain of 275 points. Yesterday, the index rose 7.68 points or 0.04% at 18082.21

Yesterday, the small-cap Russell 2000 fewl -26.54 points or -1.19% at 2197.45

European stock indices are trading higher

- German DAX, +1.11%

- France CAC, +1.57%

- UK FTSE 100, +0.13%

- Spain’s Ibex, +1.15%

- Italy’s FTSE MIB, +1.37% (delayed 10 minutes).

Shares in the Asian Pacific markets China and Hong Kong continue to search after aggressive China stimulus:

- Japan’s Nikkei 225, +2.7%

- China’s Shanghai Composite Index, +3.61%

- Hong Kong’s Hang Seng index, +4.16%

- Australia S&P/ASX index, +0.95%

Looking at the US debt market, yields are higher

- 2-year yield 3.534%, -1.8 basis points. at this time yesterday, the yield was at 3.540%

- 5-year yield 3.501%, -2.4 basis points. At this time yesterday, the yield was at 3.402%

- 10-year yield 3.758%, -2.3 basis points. At this time yesterday, the yield is at 3.762%

- 30-year yield 4.115%, -1.9 basis points..At this time yesterday, the yield is at 4.111%

Looking at the treasury yield curve, is similar to yesterday’s levels at this time

- The 2-10 year spread is at +22.3 basis points. At this time yesterday, the yield spread was +21.9 basis points.

- The 2-30 year spread is at +57.8 basis points. At this time yesterday, the yield spread was +57 basis points.

In the European debt market, the 10 year yields are mostly lower:

This article was written by Greg Michalowski at www.forexlive.com.

Source link