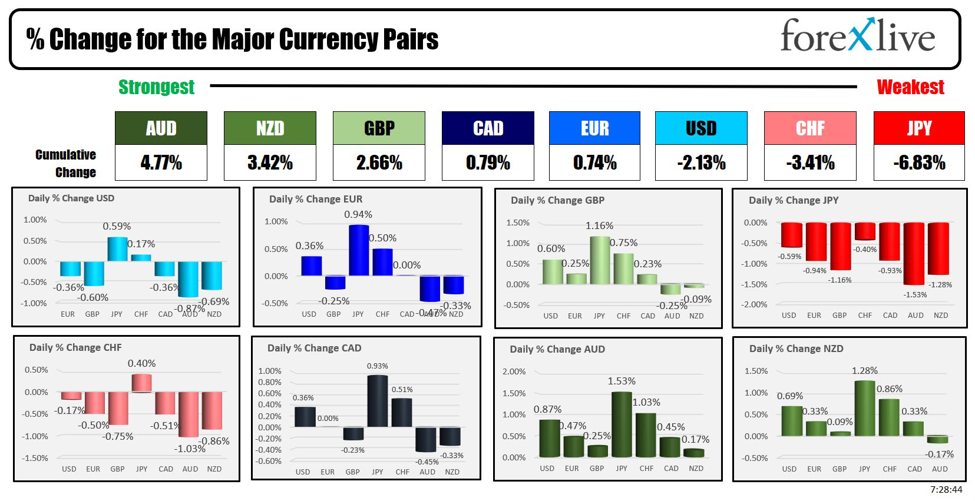

As the North American session begins the AUD is the strongest and the JPY is the weakest. The USD is lower but with gains vs the JPY and the CHF. The USD is lower by 0.60% vs the GBP after the BOE kept rates unchanged a meeting after cutting by 25 basis points. The bullet points from the MPC Summary said:

- MPC aims to meet the 2% inflation target, supporting growth and employment.

- Majority vote (8-1) to keep the Bank Rate at 5%; 1 member favored a 0.25% cut to 4.75%.

- Unanimous decision to reduce UK government bond holdings by £100 billion over the next year, lowering the total to £558 billion.

- Policy remains focused on tackling inflation to return it to 2% sustainably and maintaining anchored inflation expectations.

- Three scenarios for inflation persistence: global shock easing, economic slack required, or structural shifts.

- Global growth steady; oil prices declined, reflecting weaker demand, with mixed signals on short-term outlook.

- UK GDP forecast to grow by 0.3% per quarter in the second half of 2024; CPI inflation was 2.2% in August, expected to rise to 2.5% by year-end.

- Monetary policy will remain restrictive for as long as needed to ensure inflation returns to target.

It is the day after…..The US Federal Reserve cut rates by 50 basis points yesterday.The decision was around 50-50 going into the decision. The initial reaction saw the stocks moving higher, yields lower and the USD lower. By the end of the US session, the USD was still lower overall, but well off the lows. Yields were higher and stocks gave up their gains. Today, the yield curve is steeper, the US dollar is mostly lower and the major US stock indices are sharply higher as markets not cheer the “recalibration” of rates, and an economy that is still expected to grow 2% with steady inflation and unemployment modestly higher (according to the Fed projections).

It seems so perfect. What possibly could go wrong? TBD.

Nevertheless, with the premarket gains in the Dow and the S&P, both of those indices are currently on track to trade to new record levels. The Dow previous high was 41981.97 reached yesterday. It closed at 41503.10 or 468 points away. The Dow futures are implying a gain of 476 points currently.

The S&P all-time high reached 5689.75 and closed at 5618.26 (or 71 points away) before rotating back to the downside. The S&P futures are implying a gain of 90.25 points currently.

In other central bank commentary:

- ECB executive board member Isabel Schnabel highlighted that sticky inflation in the services sector is keeping headline inflation at elevated levels. She noted that price pressures within services are broad-based and global, with a stronger pass-through of higher wages to producer prices compared to other sectors. The momentum in services inflation remains high, surpassing levels consistent with price stability. While medium-term inflation projections are generally clustered around the ECB’s 2% target, Schnabel expects wage growth to slow as past price shocks unwind. Private sector forecasts suggest that conditions for a soft landing remain intact, though there are signs that the transmission of the ECB’s monetary policy tightening is starting to weaken

- ECB’s Panetta and dove said that interest rate reductions could accelerate in the next months

- ECB’s Knot said there is room for further cuts if inflation outlook holds. The ECB had rates by 25 basis points at the last meeting, but into the implying that rates would remain unchanged in October

- Bank of Canada Deputy Governor Nicolas Vincent clarified that when the central bank indicated in July that downside risks were becoming more important, it did not mean these risks had strengthened, but rather that with the 2% inflation target in sight, more consideration was given to the risk of inflation falling below target. He emphasized that reaching a consensus on rates strengthens the decision-making process, as differences in opinion tend to narrow as new data and information emerge. A consensus-based rate announcement reflects an agreement among Governing Council members on the best course of action at a particular moment, although individual members may still have differing views on the future path for interest rates.

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down up $0.69 or 0.99% at $70.57. At this time yesterday, the price was at $69.44

- Gold is trading up $29.98 or 1.17% at $2588.70. At this time yesterday, the price was $2577.07

- Silver is trading up $1.08 or 3.63% at $31.14. At this time yesterday, the price is at $30.58

- Bitcoin is trading at $62,587. At this time yesterday, the price was at $59,763. GOP nominee and former Pres. Trump visited a crypto bar in New York City yesterday as he stumps for crypto industry voting block.

- Ethereum is trading at $2433.20. At this time yesterday, the price was at $2299.05.

In the premarket, the snapshot of the major indices are sharply higher after giving up gains yesterday in closing lower..

- Dow Industrial Average futures are implying a gain of 475.90 points. Yesterday, the index fell -103.08 points or -0.25% at 41503.10

- S&P futures are implying a gain of 90.25 points. Yesterday, the price fell -16.32 points or -0.29% at 5618.26. Yesterday seven day win streak was snapped.

- Nasdaq futures are implying a gain of 409 points. Yesterday, the index fell -54.76 points or -0.31% at 17573.30.

Yesterday, the small-cap Russell 2000 was higher by 16.30 points or 0.74% at 2205.477.

European stock indices are trading higher:

- German DAX, +1.66%

- France CAC, plus a 2.00%

- UK FTSE 100, +1.03%

- Spain’s Ibex, +0.70%

- Italy’s FTSE MIB, +1.01% (delayed 10 minutes).

Shares in the Asian Pacific markets closed higher

- Japan’s Nikkei 225, +2.13%

- China’s Shanghai Composite Index, +0.69%

- Hong Kong’s Hang Seng index, +2.00%

- Australia S&P/ASX index, +0.61%

Looking at the US debt market, yields are mixed with the shorter end lower in the longer and higher (steeper yield curve). Versus yesterday at this time, the two year yield is lower. The five year yield is unchanged, and the 10 and 30 year yields are higher:

- 2-year yield 3.577%, -2.6 basis points. At the same Friday, the yield was at 3.628%

- 5-year yield 3.473%, +0.9 basis points at this time Friday, the yield was at 3.472%

- 10-year yield 3.715%, +2.8 basis points. At this time Friday, the yield is at 3.681%

- 30-year yield 4.046%, +3.9 basis points. At this time Friday, the yield is at 3.994%

Looking at the treasury yield curve, it has gotten steeper since his time yesterday.,

- The 2-10 year spread is +13.3 basis points. At this time yesterday, the yield spread was +5.5 basis points.

- The 2-30 year spread is +46.5 points. At this time yesterday, the yield spread was +36.7 basis points.

In the European debt market, the 10 year yields are higher:

This article was written by Greg Michalowski at www.forexlive.com.

Source link