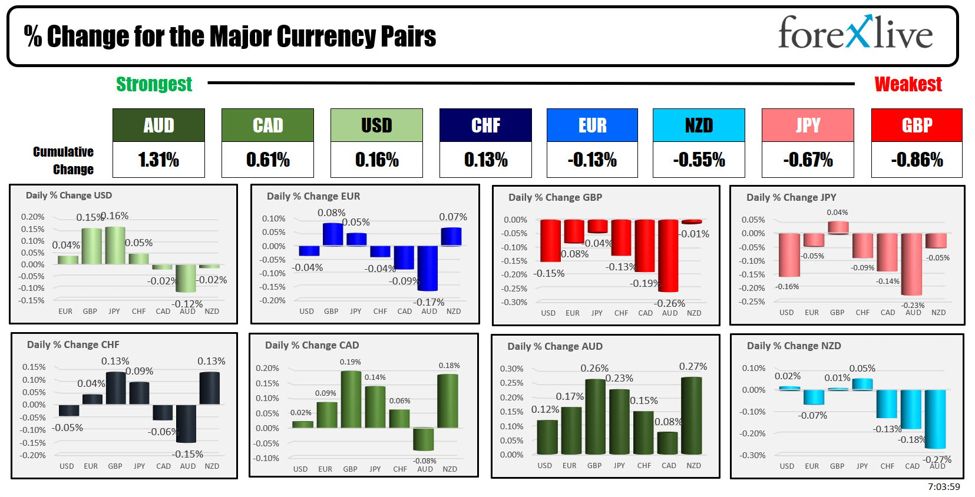

As the North American session begins the AUD is the strongest and the GBP is the weakest. Australia employment change was higher than expectations with a gain of 50.2 K vs 19.9K estimate. That helped to prop up the pair.

The USD is mixed with little changes vs all the major currencies. Up-and-done trading has dominated many of the major currencies vs the greenback today. The USDJPY has a 122 pip trading range by the pair is only up 0.16% on the day. The EURUSD meanwhile only has a 15 pip trading range, the USDCAD only 18 pips and the NZDUSD 19 pips. Each of those pairs are obviously only modestly changed from yesterday’s closing levels.

The ECB kept rates unchanged as expected with the refinancing rates remaining at 4.25%. ECB Pres. Lagarde’s traditional press conference will begin at 8:45 AM ET.

US initial jobless claims (230K estimate versus 222K last week) and continuing claims (1.855M vs 1.852M last week) will be released at the bottom of the hour along with the Philadelphia Fed business index (2.9 expected versus 1.3 last month).. The jobless claims this week will be the same week as the BLS survey for next months US employment data.

Today Fedspeak includes Fed’s Logan during the US session. Feds Daly and Bowman will be speaking later this evening:

- 1:45 PM ET Federal Reserve Bank of Dallas President Lorie Logan gives opening remarks

- 6:05 PM ET Federal Reserve Bank of San Francisco President Mary Daly participates in fireside chat

- 7:45 PM ET Federal Reserve Board Governor Michelle Bowman speaks on “Accountability and Reform”

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading down $1.67 or -2.0% at $81.18. At this time yesterday, the price was at $81.16

- Gold is trading up $7.86 or 0.32% at $2466.07. At this time yesterday, the price was trading at $2471.37.

- Silver is trading up $0.12 or 0.39% at $30.39. At this time yesterday, the price is trading at $31.02

- Bitcoin trading at $64,852. At this time yesterday, the price was trading at $64,751

- Ethereum is also trading at $3465.30. At this time yesterday, the price was trading at $3455

In the premarket, the snapshot of the major indices are trading mixed with the Dow Industrial Average average lower and the S&P and NASDAQ trading higher. Yesterday the indices did the exact opposite with the Dow rising and the NASDAQ index falling sharply:

- Dow Industrial Average futures are implying a decline of – 61.08 points. Yesterday, the Dow Industrial Average rose 243.60 points or 0.59% at 41,198.09

- S&P futures are implying a gain of 8.9 points. Yesterday, the S&P index closed lower by -78.93 points or -1.39% at 5588.28

- Nasdaq futures are implying a gain of 90.03 points. Yesterday, the index tumbled by 512.42.4 -2.77% to 17996.92. That was the largest client going back to December 2022

- The Russell 2000 index fell by -24.00 points or -1.06% at 2239.66.

European stock indices are trading higher across the board:

- German DAX, +0.21%

- France CAC +0.65%

- UK FTSE 100, +0.63%

- Spain’s Ibex, +0.68%

- Italy’s FTSE MIB, +0.65% (delayed 10 minutes).

Shares in the Asian Pacific markets closed mixed.

- Japan’s Nikkei 225, -2.36%

- China’s Shanghai Composite Index, +0.48%

- Hong Kong’s Hang Seng index, +0.22%

- Australia S&P/ASX index, -0.27%

Looking at the US debt market, yields are higher:

- 2-year yield 4.462%, +3.4 basis points. At this time yesterday, the yield was at 4.476%

- 5-year yield 4.106%, +3.5 basis points. At this time yesterday, the yield was at 4.116%

- 10-year yield 4.182%, +3.7 basis points. At this time yesterday, the yield was at 4.179%

- 30-year yield 4.397%, +4.1 basis points. At this time yesterday, the yield was at 4.381%

Looking at the treasury yield curve is a little steeper (but still negative):

- The 2-10 year spread is at -27.6 basis points. At this time yesterday, the spread was at -29.7 basis points.

- The 2-30 year spread is -6.4 basis points. At this time yesterday, the spread was at -9.5 basis points

This article was written by Greg Michalowski at www.forexlive.com.

Source link