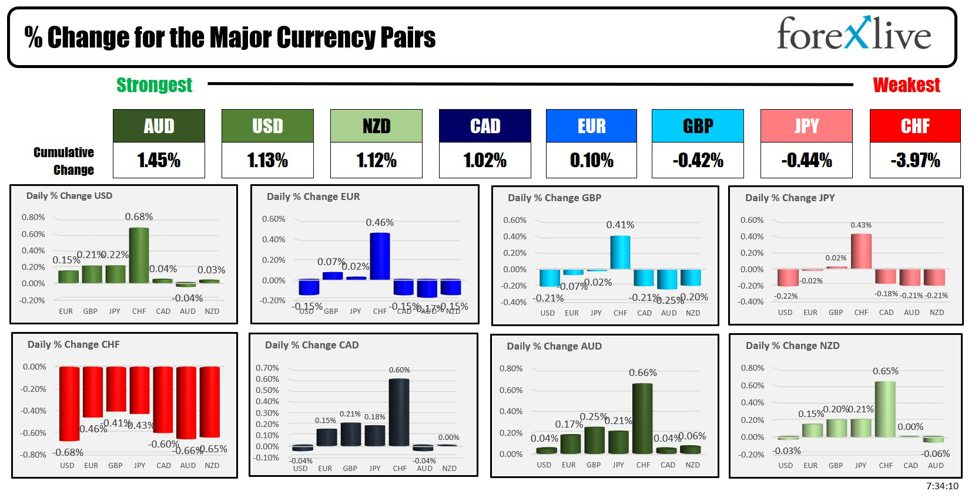

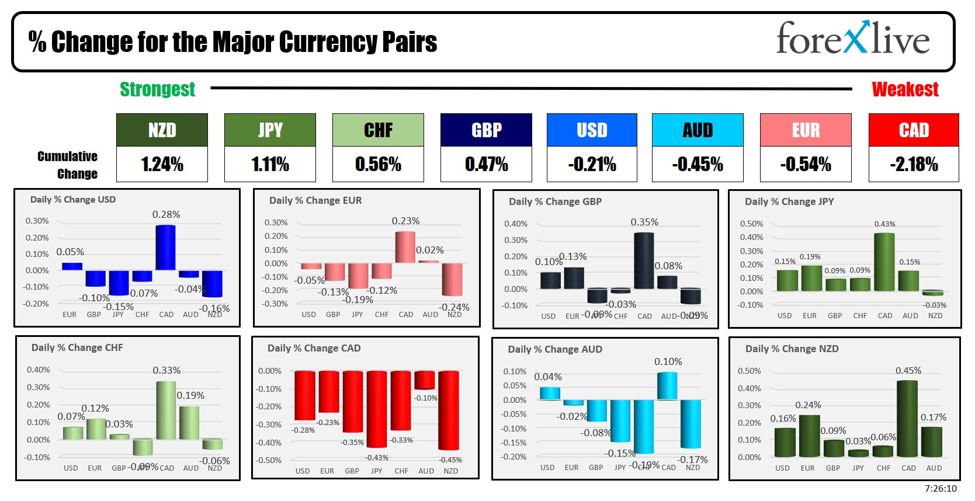

As the North American session begins the AUD is the strongest and the CHF is the weakest. The USD is mostly stronger with declines only vs the AUD.

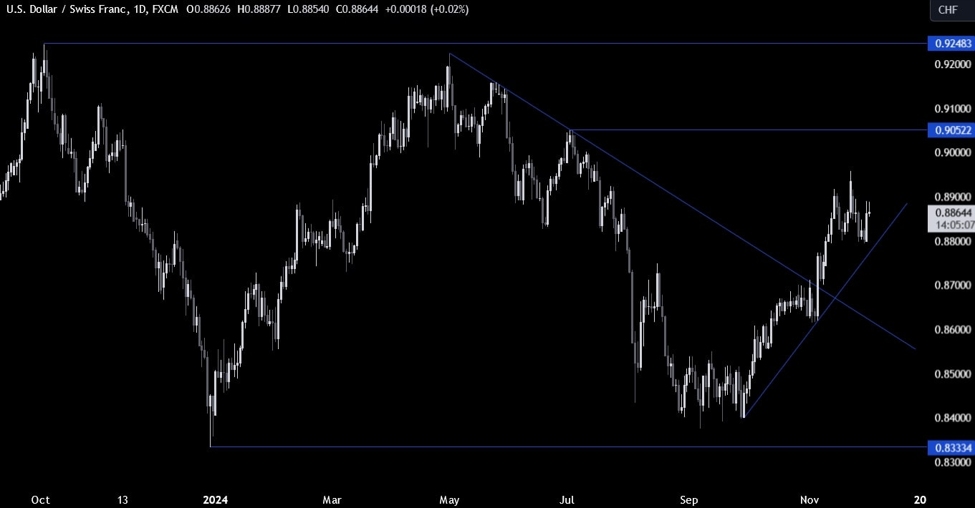

The Swiss National Bank (SNB) lowered its key policy rate by 25 basis points, bringing it down to 1.25% from the previous 1.50%. This decision, announced as part of its June 2024 monetary policy update. The USDCHF rose (lower CHF ) by 0.68% and the EURCHF gained 0.46%.

The SNB highlighted that the current inflation in Switzerland is driven primarily by higher prices for domestic services. Nevertheless, it adjusted its inflation forecasts slightly downward, now projecting 1.3% for 2024 (previously 1.4%), 1.1% for 2025 (previously 1.2%), and 1.0% for 2026 (previously 1.1%).

Additionally, the SNB emphasized its readiness to intervene in the foreign exchange market if needed and reiterated its commitment to maintaining appropriate monetary conditions. The central bank stated it would adjust its monetary policy as necessary to ensure inflation remains within a range consistent with price stability over the medium term.

Meanwhile the BOE kept their policy rate unchanged today. However, as Justin pointed out the Bank of England’s latest statement includes subtle dovish hints suggesting potential rate cuts in the near future. In the forward guidance, the BOE added, “As part of the August forecast round, members of the Committee will consider all of the information available and how this affects the assessment that the risks from inflation persistence are receding.” This points to the possibility of a rate cut in August if current data trends continue.

Additionally, the BOE is already finding excuses to dismiss the stubbornly high services inflation. They stated, “The upside news in services price inflation relative to the May Report did not alter significantly the disinflationary trajectory that the economy was on. This view was supported by evidence that the recent strength in services inflation included regulated and indexed components of the basket, and volatile components. Such factors would not push up medium-term inflation.” The fact that the policy decision was “finely balanced” indicates that policymakers are giving significant thought to the next step, potentially setting the stage for rate cuts.ECB policymaker Klaas Knot indicated that the optimal policy path aligns with just under three rate cuts in 2024. He emphasized the need for recalibrating the policy stance during projection meetings due to high uncertainty, advocating a data-dependent approach. Knot acknowledged the disinflation process remains uneven and core inflation signals are not entirely positive. He noted that while small deviations from the inflation target can be overlooked, larger deviations require a strong response. This supports the idea of one or two more rate cuts this year, with market pricing anticipating around 40 basis points of cuts for the remainder of 2024

A snapshot of the other markets as the North American session begins shows:

- Crude oil is trading up $0.14 at $80.84. At this time yesterday, the price was at $80.86.

- Gold is trading up $11.09 or +0.50% at $2339.61.. At this time yesterday, the price was trading at $2330.40

- Bitcoin trades lower at $66056. At this time yesterday, the price was trading up at $65,190.

- Ethereum is also trading lower at $3597.60. At this time yesterday, the price was trading at $3535.47

In the premarket, the snapshot of the major indices are trading higher after record closes in the S&P and NASDAQ indices on Tuesday. The markets were closed yesterday in observance of Juneteenth:

- Dow Industrial Average futures are implying a gain of 42.34 poitns. On Tuesday, the Dow Industrial Average rose by 56.76 points or 0.15% at 38834.87

- S&P futures are implying gain of 23.97 points. On Tuesday, the S&P index closed up 13.78 points or 0.25% at 5487.02. The closing level was a new record again.

- Nasdaq futures are implying a gain of 113 points points. On Tuesday, NASDAQ index also closed at a record level with a gain of 5.21 points or 0.03% at 17862.23

European stock indices are trading higher in European trading:

- German DAX, +0.49%.

- France CAC +0.83%.

- UK FTSE 100, 0.30%.

- Spain’s Ibex, +0.46%.

- Italy’s FTSE MIB, +1.04% (delayed 10 minutes)..

Shares in the Asian Pacific markets were mixed

- Japan’s Nikkei 225, +0.16%

- China’s Shanghai Composite Index, -0.42%

- Hong Kong’s Hang Seng index, -0.52%

- Australia S&P/ASX index, unchanged

Looking at the US debt market, yields are higher. Markets were closed yesterday but fell on Tuesday:

- 2-year yield 4.729%, +1.7 basis points. At this time Tuesday, the yield was at 4.774%

- 5-year yield 4.266%, +3.2 basis points. At this time Tuesday, the yield was at 4.315%

- 10-year yield 4.246%, +3.1 basis points. At this time Tuesday, the yield was at 4.289%

- 30-year yield 4.38%, +3.3 basis points. At this time Tuesday, the yield was at 4.416%

Looking at the treasury yield curve the spreads are steady

- The 2-10 year spread is at -48.3 basis points. At this time Friday, the spread was at -48.0 basis points.

- The 2-30 year spread is at -35.0 basis points. At this time Friday, the spread was at -36.0 basis points.

This article was written by Greg Michalowski at www.forexlive.com.

Source link