- Prior 56.9

- Composite PMI 55.8

- Prior 56.6

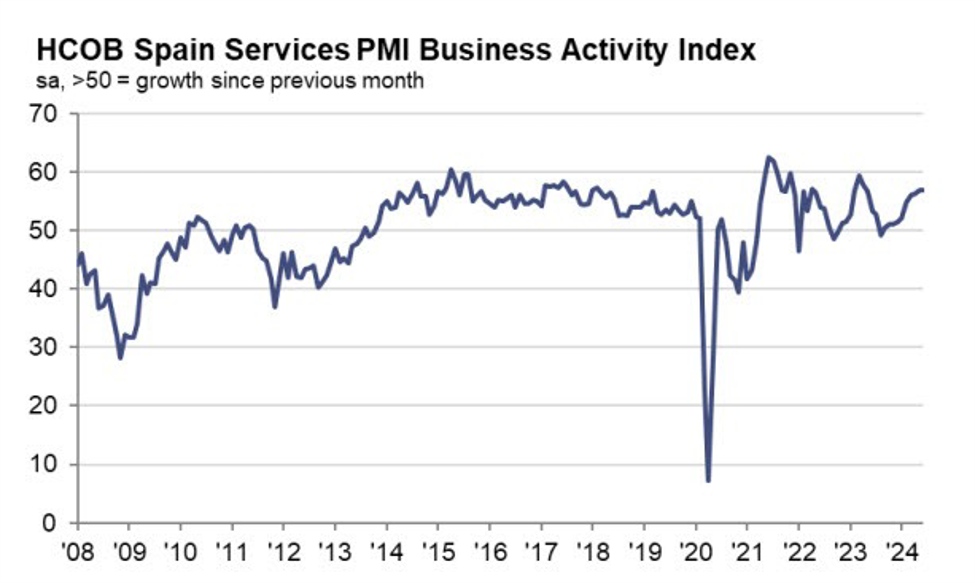

The reading is just marginally softer than the 13-month high in May, reaffirming that business activity remains robust in Spain’s services sector. The only downside is that the trend in prices is still strong, so that’s not too comforting on the inflation front. HCOB notes that:

“The Spanish services sector remains unshaken. After the PMI for Spain’s manufacturing sector lost some growth

momentum in June following the European elections, the services sector maintains its pace. The growth results from

continued high demand, which has been further strengthened, exclusively from abroad. Expectations for the future dipped a

bit but still remained solid. Some panellists believe that activity is still going to increase due to lower inflation and interest

rates in a year’s time. Supported also by these high expectations for the future, companies are trying to hire more workers.

The efforts also seem to be yielding initial results, as workloads can increasingly be managed.

“The increase in employment in June came with the added expense of increasing average wage levels. Despite some

reports of rising food and energy prices, anecdotal evidence indicates that higher wages are the key factor in the further rise

in input costs. Companies are managing to pass on these increased costs to consumers.

“The Spanish economy continues to perform strong. Overall, the Composite PMI for Spain fell slightly from 56.6 to 55.8 in

June, but this should not overshadow the current strength, as activity increased in both sectors in June, albeit slightly

moderated in manufacturing. Therefore, we expect growth above the historical average in the second quarter – after the

strong GDP prints of the last two quarters were revised upwards again.”

This article was written by Justin Low at www.forexlive.com.

Source link