Fundamental

Overview

The S&P 500 has been on

a sustained rally ever since the last FOMC decision with the market continuing

to price in a back-to-back 50 bps cut in November. More recently, the PBoC

surprised with strong easing measures as Chinese officials seem to have finally

decided to go bigger. The market might now looking forward to a pick-up in global

growth.

On the economic data side, the

latest US consumer confidence surprised to the downside with worrying labour

market data, but the market quickly faded the reaction. One possible reason

could be that the data didn’t incorporate the latest Fed’s decision so the

market might want to wait a bit more to see if things pick up in the next

months.

S&P 500

Technical Analysis – Daily Timeframe

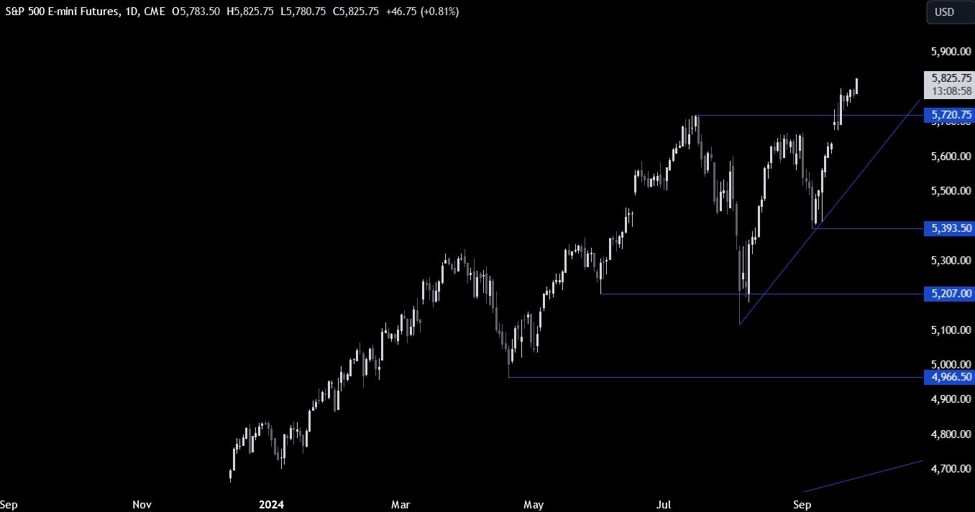

On the daily chart, we can

see that the S&P 500 continues to print new all-time highs supported by the

dovish market pricing and more recently the strong Chinese easing measures.

From a risk management perspective, the buyers will have a better risk to

reward setup around the previous all-time high around the 5720 level. The

sellers, on the other hand, will want to see the price breaking lower to

position for a drop into the trendline.

S&P 500 Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see that we had some consolidation recently around the highs but the price

broke out overnight and extended the gains into new highs. If we get a

pullback, the buyers will likely step in around the 5800 level to position for

the continuation of the uptrend. The sellers, on the other hand, will want to

see the price breaking lower to pile in for a drop into the 5720 level.

S&P 500 Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see more clearly the recent price action with the breakout of the ascending

triangle overnight. There’s not much else to add as the buyers will want to

wait for a pullback, while the sellers will look for the price falling back

below the 5800 level to invalidate the bullish setup and position for the drop

into the 5720 level. The red lines define the average daily range for today.

Upcoming

Catalysts

Today we get the latest US Jobless Claims figures, while tomorrow we conclude

the week with the US PCE report.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link