The highlight on the North American economic calendar today is the Canadian July employment report but it comes amidst sign that consumer spending is slowing down.

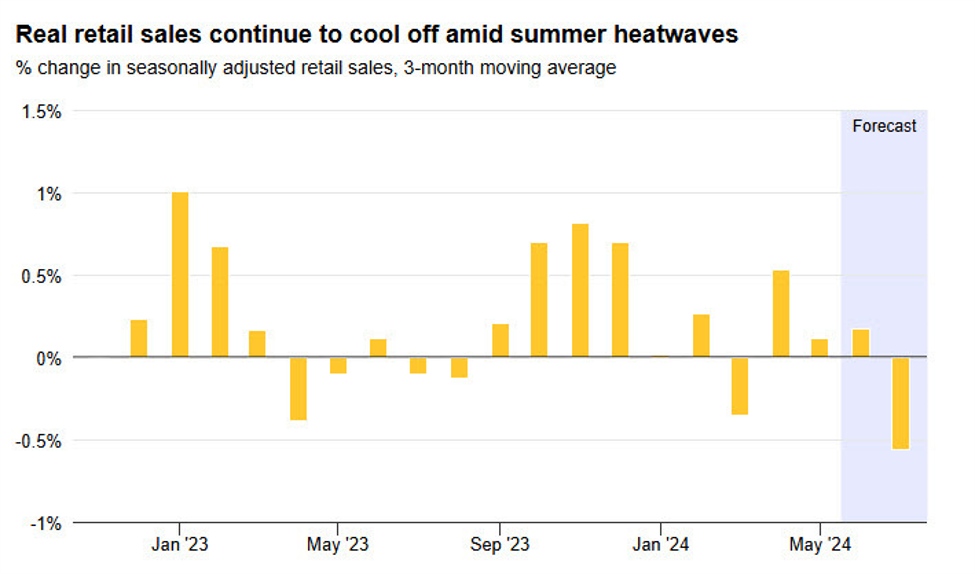

RBC is out with its latest consumer spending tracker based on credit card data and Canada’s largest bank saw a 0.6% decline in July.

“Canadian consumers are pulling back this summer after years of pandemic revenge spending,” RBC writes, nothing that sales have fallen in six of the past seven months.

The report notes that spending on food and drinking establishments was particularly hard hit in July, falling 0.88% in a sign of a belt-tightening consumer. Home-related spending also fell 3.3% as high interest rates bite.

Consumer spending continues to show signs of stress as many wait for the impact of the BoC rate cuts to filter through to mortgage interest costs. Interest rates are still high. Canadians renewing fixed-rate mortgages in 2024 still face significantly higher rates, which will cut into broader purchasing power. However, as the BoC continues its path to lower rates, mortgage holders will feel some relief and at least partially restored purchasing power upon renewal. We expect consumption will remain soft (relative to still-strong population growth) over the second half of the year before picking up in 2025 as the BoC continues to ease monetary policy.

At 8:30 am ET today (1230 GMT), the Canadian jobs report for July is expected to show unemployment ticking up to 6.5% from 6.4%. Job gains of 22.5K are expected after a loss of 1.4K in June.

The market is pricing in a 90% chance of a 25 bps Bank of Canada cut on Sept 4 with a 10% probability of 50 bps. A 25 bps cut is fully priced in at all three remaining meetings this year, which would bring the overnight rate to 3.75%.

This article was written by Adam Button at www.forexlive.com.

Source link