This will be an unusual US trading week with a holiday sandwiched in the middle on Wednesday.

Before that, we get the data highlight of the week with the May US retail sales report. The consensus is for a 0.2% rise following a flat number in May.

The question on my mind is if we’re switching to a mode where the market gets increasingly worried about US growth and begins to fret that the Fed is falling behind the curve. A tell will be in the market reaction to whatever the data is because for the past 18 months there has been a bad-news-is-good-news trading theme and I’m not sure it will survive the summer.

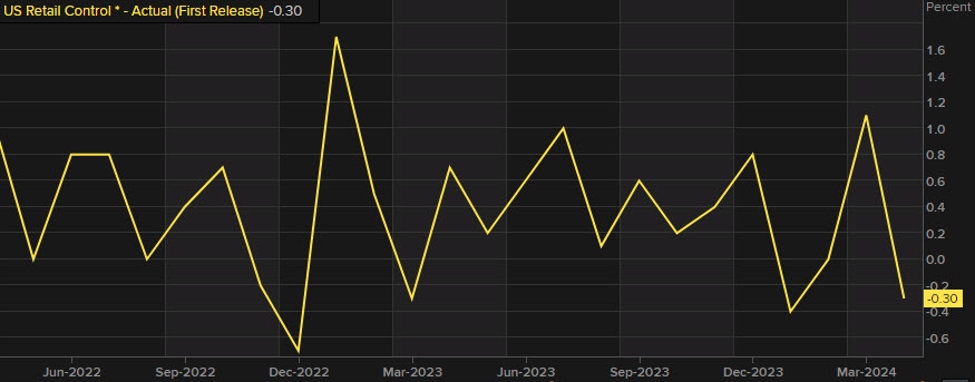

Drilling down into the report, the most-important metric will be the control group, or retail sales excluding autos, gasoline and building materials. It’s expected to rebound 0.4% after a 0.3% decline in April.

Bank of America is relatively upbeat on the number, seeing a 0.6% rise in the control group with some help from seasonal factors. However their card data was weak in many areas, including clothing, restaurants and general merchandise with overall spending down 0.9% m/m seasonally adjusted. Still, if you look back at the April data, it was healthier than the flat reading in the official report. That could mean some statistical noise, revisions or payback for May.

Corporates so far haven’t offered up much evidence of a slowing US consumer and there is ample room for strong spending from built-up household wealth, low fixed mortgage rates and equity market gains.

Looking further ahead, Bank of America reports today that card spending was up 1.6% y/y in the first week of June

This article was written by Adam Button at www.forexlive.com.

Source link