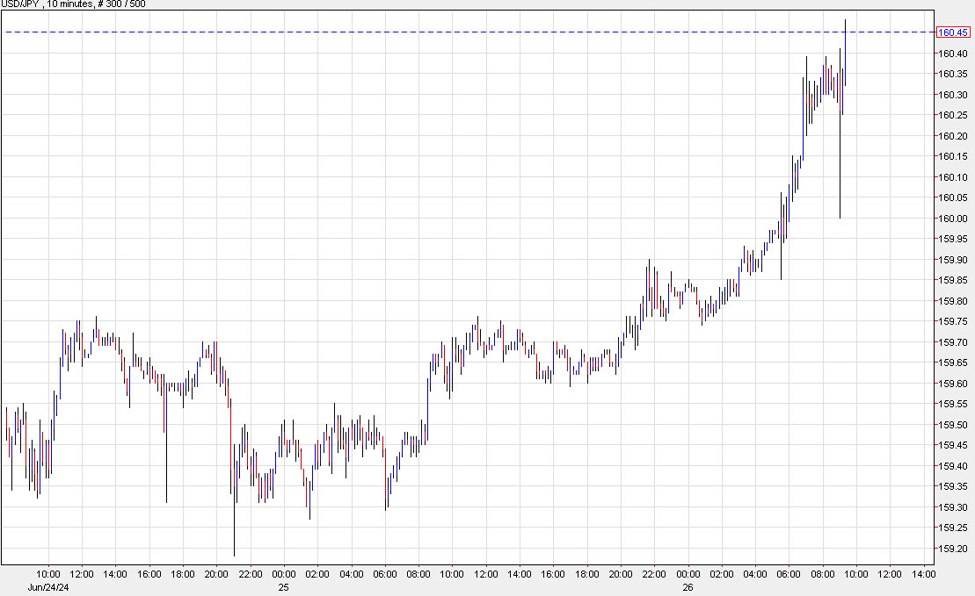

The People’s Bank of China has cut rates:

- PBoC announces cut to 7-day reverse repo rate to 1.70% from 1.80%

And have also eased MLF requirements:

- PBOC to lower collateral for Medium-term Lending Facility (MLF) loans

The Loan Prime Rate (LPR) setting is due at 0115 GMT (2115 US Eastern time). The cuts we have already seen are suggestive of a cut to one or both LPRs. Its not locked in, but expectations have heightened.

Current LPR rates are:

- 3.45% for the one year

- 3.95% for the five year

***

—

The PBOC’s Loan Prime Rate (LPR):

- Its an interest rate benchmark used in China, set by the People’s Bank of China each month.

- The LPR serves as a reference rate for banks when they determine the interest rates for (primarily new) loans issued to their customers.

- Most new and outstanding loans in China are based on the one-year LPR, while the five-year rate influences the pricing of mortgages.

- Its calculated based on the interest rates that a panel of 18 selected commercial banks in China submit daily to the PBOC.

- The panel consists of both domestic and foreign banks, with different weights assigned to each bank’s contributions based on their size and importance in the Chinese financial system.

- The LPR is based on the average rates submitted by these panel banks, with the highest and lowest rates excluded to reduce volatility and manipulation. The remaining rates are then ranked, and the median rate becomes the LPR.

This article was written by Eamonn Sheridan at www.forexlive.com.

Source link