Fundamental

Overview

The Nasdaq finally erased the entire drop from the last ISM

Manufacturing PMI as the market faded the “growth scare”. The first catalyst

was the good US

Jobless Claims on the 8th of August as that quelled the fears on

a deteriorating labour market triggered by the weak NFP

report.

Last week, we got even better Jobless

Claims figures and a great Retail

Sales report which increased the bullish momentum. The market’s focus is

now clearly on growth. This week, we will have two key events.

The first will be on Thursday as we will get the release of the US Flash

PMIs for August and that will be kind of a test for the thesis that the July

data was negatively affected by Hurricane Beryl. The second one will be Fed

Chair Powell’s speech at the Jackson Hole Symposium where he will likely

pre-commit to a rate cut in September.

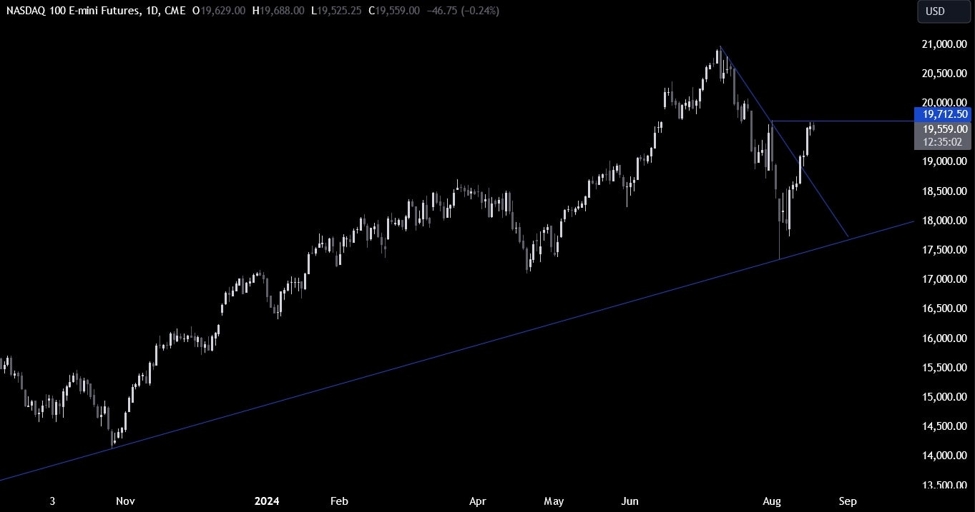

Nasdaq

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that the Nasdaq broke above the key trendline and extended the gains into the key

19712 level. This is where we can expect the sellers to step in with a defined

risk above the level to position for a drop into the major trendline around the

18000 level. The buyers, on the other hand, will want to see the price breaking

higher to increase the bullish bets into new highs.

Nasdaq Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see that we an upward trendline defining the current bullish momentum. If we

were to get a bigger pullback, the buyers will likely lean on the trendline

where they will also find the 38.2% Fibonacci

retracement level for confluence.

The sellers, on the other hand, will want to see the price breaking lower to

increase the bearish bets into the 18000 level.

Nasdaq Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see that we have a steeper minor upward trendline that’s been acting as support

for the buyers as they kept on leaning on it to push into higher highs. This is

where we will likely see them stepping in again with a defined risk below the

last higher low at 19445 to position for a break above the key resistance.

The sellers, on the other

hand, will want to see the price breaking below the trendline and the 19445

level to increase the bearish bets into the other trendline around the 19000

level. The red lines define the average daily range for today.

Upcoming Catalysts

Today we have Fed’s Waller speaking. On Thursday we get the US Jobless Claims

figures and the US PMIs. On Friday we conclude with Fed Chair Powell speaking

at the Jackson Hole Symposium.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link