Reuters with the report, citing a Morgan Stanley said in commentary to institutional clients on Thursday:

- Computer-driven macro

hedge fund strategies on Wednesday sold $20 billion in equities - set to shed at least more $25 billion over the next week

- one of the largest risk-unwinding

events in a decade - “The volatility of the last two weeks started out being very

rotational,” - “But that has now morphed

into a broad index deleveraging (on Wednesday).” - If volatility persists in the coming days, the sell-off

would rapidly increase - An additional 1% day-drop in

global equities could spark sales of $35 billion and macro hedge

funds could dump up to $110 billion in a 3% day fall

—

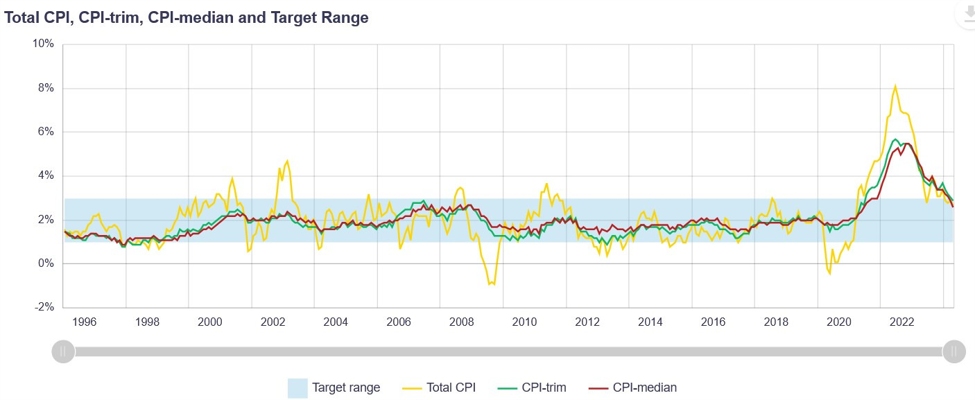

Keep your eye on JPY, the carry trade deleveraging is a huge driver. 152 now the the level to watch:

This article was written by Eamonn Sheridan at www.forexlive.com.

Source link