Major dollar pairs are still keeping within 0.1% change on the day and that sums up a rather lackluster start to European trading.

The Canadian CPI report later will at least give loonie traders something to work with. Otherwise, broader markets have to look towards the overall risk mood and perhaps the Treasury auction for 2-year notes.

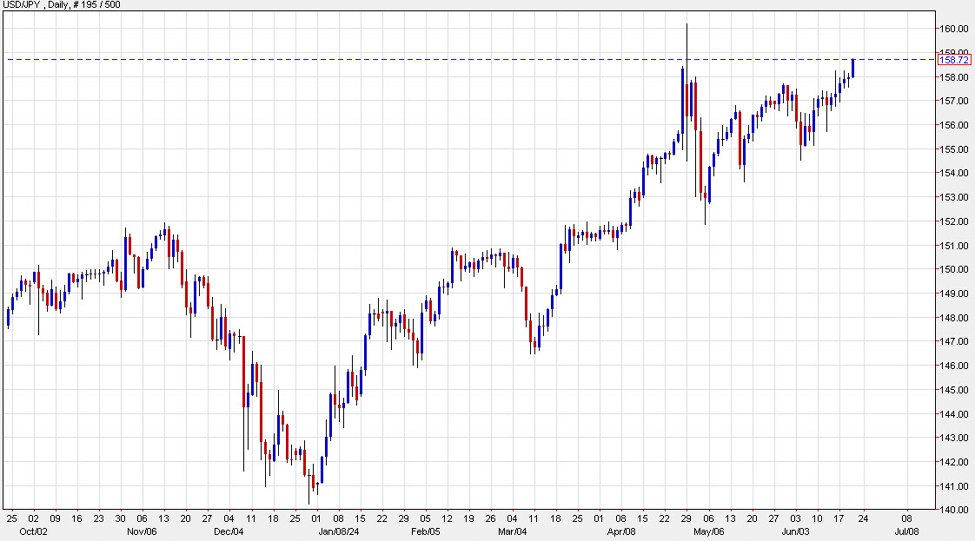

USD/JPY continues to sit on edge, bouncing around 159.30-40 levels as traders are nervy with price holding just under the 160.00 threshold. Besides that, USD/CHF continues to hold around the 0.8910-40 range after the SNB last week. But the pair is still keeping the downside for the month, lower by 1% and reaffirming the seasonal trend here at least.

Looking to the days ahead, month-end and quarter-end rebalancing flows might factor into the equation. So, just be wary of that. I still haven’t seen notes on what the bank models are suggesting just yet. But I’ll post them if and when I do. Anyway, the flows there could make things a bit tougher to read before we get into July trading next week.

This article was written by Justin Low at www.forexlive.com.

Source link