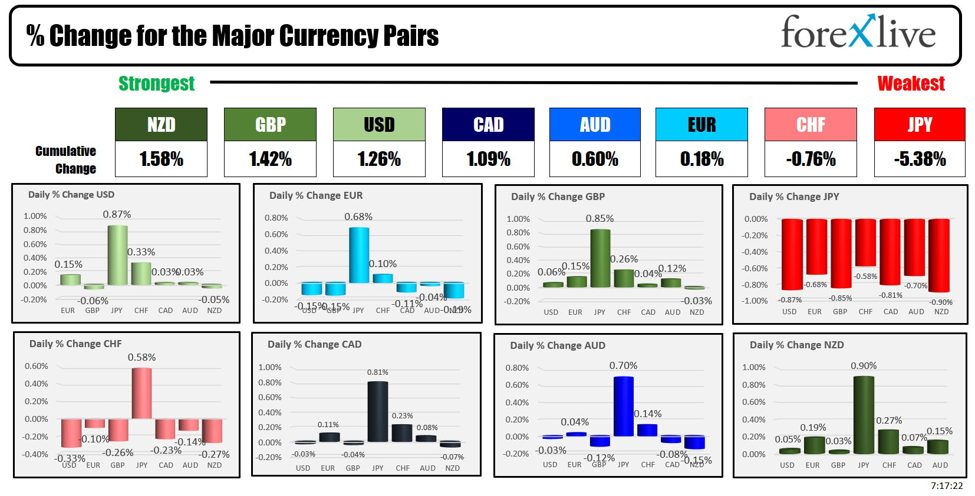

The US jobs report was a bit weaker than expectations especially when you consider the -86,000 revision to the prior month’s. Nonfarm payroll rose by 142K lower than the 161K estimate but the unemployment rate did fall to 4.2% from 4.3%.

The USD dollar had an up-and-down reaction sending the three major currency pairs to new extremes on the upside and the downside for the day.

For the EURUSD, it traded to a new high for the week but could not materially extend above a swing area between 1.3221 and 1.3230. The price has since rotated back down toward the prior highs for the week reached today and yesterday near 1.3185. The 200-hour moving average comes in at 1.31648 below and would need to be broken and stay broken to give the sellers more control.

The USDJPY fell below a swing area between 143.39 and 143.67, and moved to a new low for the week at 141.97, but could not reach the August low of 141.678. The aforementioned swing area will now be the barometer for more bullish or more bearish at least in the short term. Get above could see more upside probing on the failed break lower.

The GBPUSD fell initially and found support buyers against its 100-hour moving average of 1.31423. The price shot back to the upside extending to a swing area between 1.3221 and 1.3230. After a brief move above that level, sellers reentered push the price back down toward the highs for the day. The 200-hour moving average comes at 1.31648. That level would have to be broken to disappoint the buyers. The 100-hour moving averages at 1.31423 and as mentioned, it held support on the dip. That increases the levels importance going forward. Move below and momentum to the downside increases.

This article was written by Greg Michalowski at www.forexlive.com.

Source link