- Prior month 8.488 million revised to 8.355M

- Quits rate 2.2% versus 2.2% revised

- Vacancy rate 4.8% versus 5.0% revised

Details from the Labor Department

Job Openings

- Number of job openings: 8.1 million (little change)

- Yearly decrease: 1.8 million

- Rate: 4.8% (little change)

- Decreases:

- Health care and social assistance: -204,000

- State and local government education: -59,000

- Increases:

- Private educational services: +50,000

Hires

- Number of hires: 5.6 million (little change)

- Rate: 3.6% (unchanged)

- Increases:

- Durable goods manufacturing: +52,000

- Decreases:

- Arts, entertainment, and recreation: -45,000

- Federal government: -8,000

Separations

- Total separations: 5.4 million (little change)

- Rate: 3.4% (unchanged)

- Increase:

- Durable goods manufacturing: +49,000

Quits

- Number of quits: 3.5 million (little change)

- Rate: 2.2% (sixth month in a row)

- Decreases:

- Professional and business services: -131,000

- Increases:

- Other services: +67,000

- Durable goods manufacturing: +39,000

- State and local government education: +32,000

Layoffs and Discharges

- Number: 1.5 million (little change)

- Rate: 1.0% (unchanged)

- Decrease:

- Arts, entertainment, and recreation: -37,000

Other Separations

- Number: 349,000 (little change)

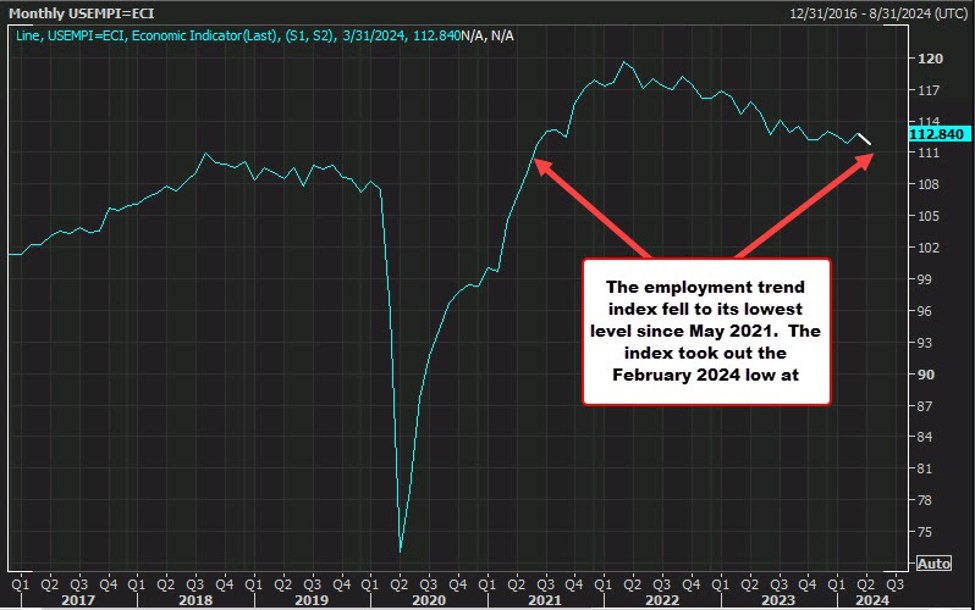

The trend to the downside in job openings continues.

US yields continue to drop:

- 2-year yield 4.772%, -4.5 basis points

- 10-year yield 4.349%, -5.3 basis points. Lowest level since May 17. The high yield back on May 29 was at 4.638% – nearly 30 basis points higher. The 10 year yield is testing its 100 and 200 day moving averages between 4.336% and 4.350%

- 30-year yield 4.504%, -4.6 basis points

The decline in yields is not helping stocks that much. The NASDAQ and S&P remain in negative territory. The Dow industrial average is higher:

- Dow industrial average was 32.5 points or 0.08%

- S&P index -12.6 points or -0.24%.

- NASDAQ index -52 points or -0.35%.

This article was written by Greg Michalowski at www.forexlive.com.

Source link