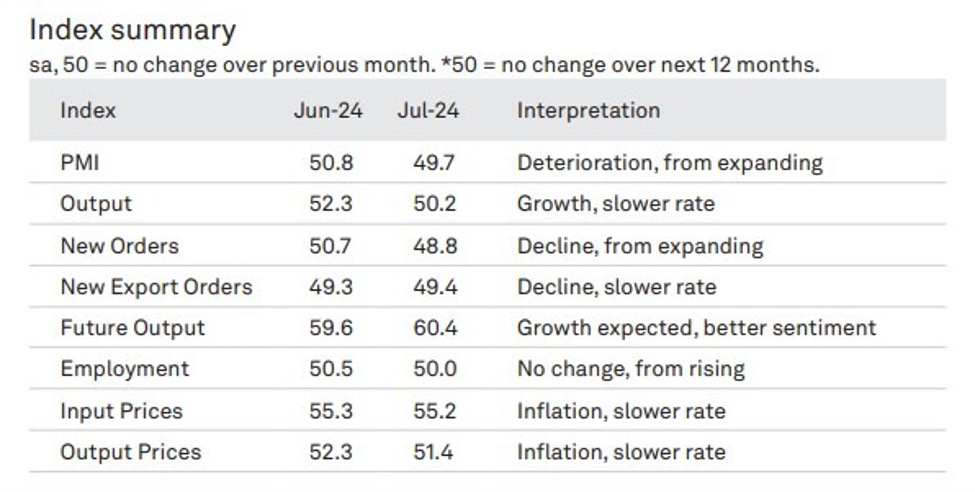

The latest JPM Global Manufacturing PMI was published on Thursday, it dipped below 50 in July, signaling a slump back into contraction

- J.P.Morgan Global Manufacturing PMI fell to 49.7 in July from 50.8 in June

- First contraction in 2024 so far, ending 6-month expansion streak

- Output growth slowed significantly, new orders declined for first time since January

- US and China saw weaker expansions, euro area remained in downturn, Japan slipped back into contraction

- Only 15 out of 32 nations registered increased manufacturing production

- Employment was unchanged overall, with gains in US and Japan offset by losses in eurozone and China

- Input costs and selling prices continued to rise, but at slower rates

The question on this is if the global manufacturing sector hit a speed bump to start H2 2024 or is something more ominous?

Similar data from the US on Thursday leans in the ‘ominous’ direction:

- US July ISM manufacturing index 46.8 vs 48.8 expected

The JPM PMI showed output barely growing and new orders falling, but with some major economies still expanding. The bigger picture has weakened noticeably though. Keep an eye on whether this is just a temporary setback or the start of a more prolonged downturn.

US Treasuries and stocks flipped to a ‘bad news is bad news’ response on Thursday. We’re not accustomed to that after ongoing BTD responses.

This article was written by Eamonn Sheridan at www.forexlive.com.

Source link