- They note that several measures of demand is slowing, and that the housing market’s sizeable imbalances make it relatively more vulnerable to the lagged impact of higher rates.

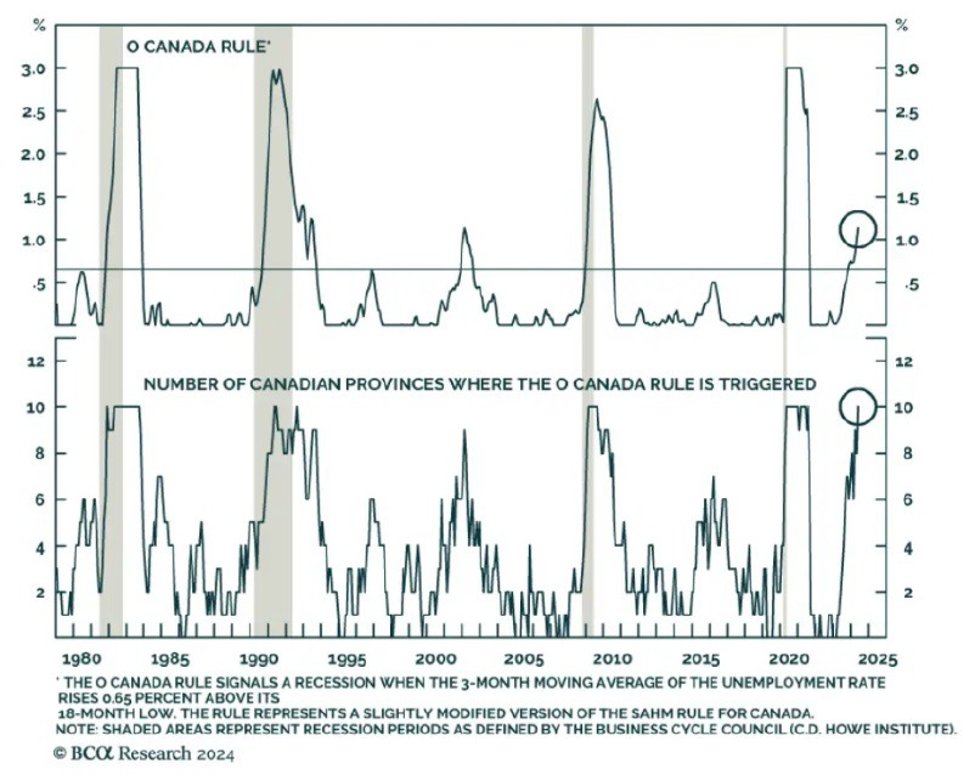

- Furthermore, they note that cutting rates now might not be enough to avoid a recession (looking at the ‘O Canada Rule’ which is based on a modified version of the Sahm Rule, Adam was out with a great note on this yesterday.

- BCA says options to navigate a Canadian recession might include overweight Canadian bonds, potentially against other country’s which might not cut as much as the BoC (Australia or the US).

- They also consider AUDCAD long exposures based on more favourable differentials for the AUD.

- Another option is being underweight the TSX relative to the S&P500.

This article was written by Arno V Venter at www.forexlive.com.

Source link