US equities are narrowly positive again today with tech leading the way. Of course, it’s Nvidia once again leading the rally with a 2.9% gain.

Earlier this week it was Apple rising by as much as 12% as it rolled out some AI features, including AI emojis, that added $380 billion to its market cap.

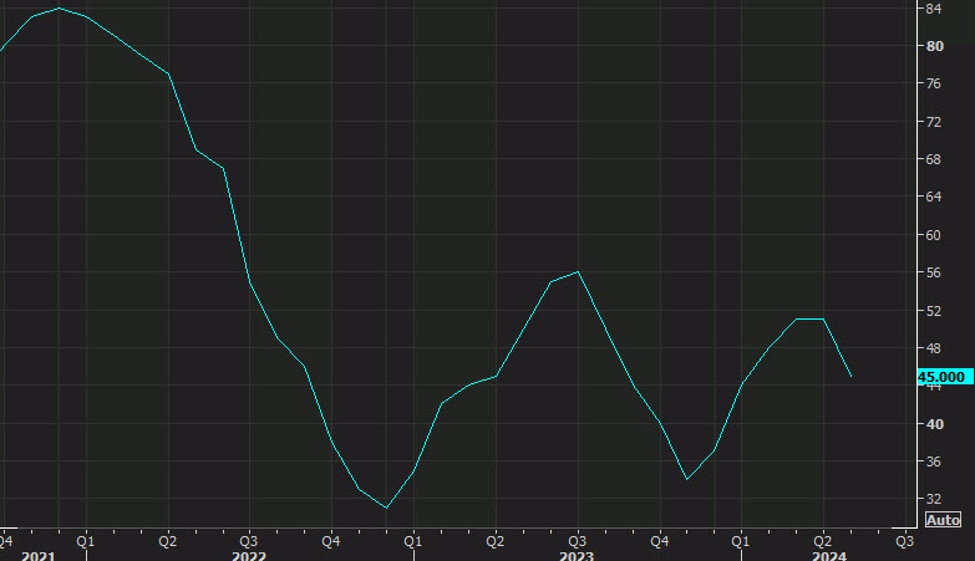

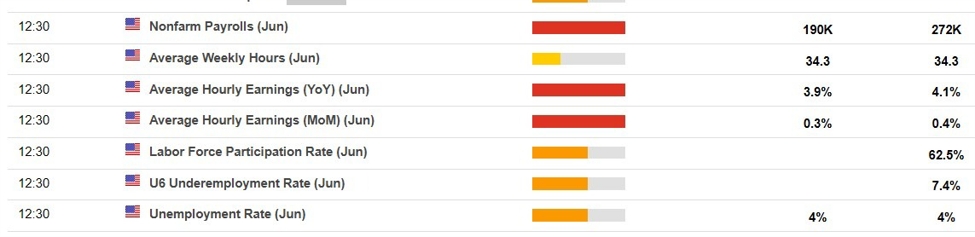

Meanwhile. there are signs that the real economy is creaking. The Russell 2000 tried to rally on the CPI data and was up as much as 3% but it’s since given nearly all of it back, and that was without coming even close to the April highs. And it was with the help of Treasury yields falling to the lowest in six weeks.

That’s an index that has stalled out and needs some near-term help from the Fed.

Now I’m a big believer in AI and how it will transform the economy and super-charge productivity but that’s a ways away and this is a market that can’t look beyond a few quarters. There are risks too that AI might not deliver or that Nvidia orders could slow down.

Moreover the real economy is under a real threat and that’s underpriced right now, at least outside of bonds.

This article was written by Adam Button at www.forexlive.com.

Source link