ICYMI, info on the US employment report, market response etc is here:

- Forexlive Americas FX news wrap 5 Jul: NFP for June sent the USD lower/yields tumbling

Meanwhile, via Goldman Sachs note:

- the report overall was softer-than-expected, and downward revisions lowered the three-month average pace to +177k from +249k as previously reported

- The industry composition was also soft, as government and healthcare accounted for three quarters of the June job gains, and several cyclical industries shed jobs

- The household survey was soft, with the unemployment rate increasing 0.1pp to 4.1%, as a 277k increase in the size of the labor force more than offset a 116k increase in household employment

GS look for more subdued numbers ahead:

- Our estimate of the underlying pace of job growth based on the payroll and household surveys now stands at 147k, though we estimate that counting immigration fully would boost this by roughly 20k.

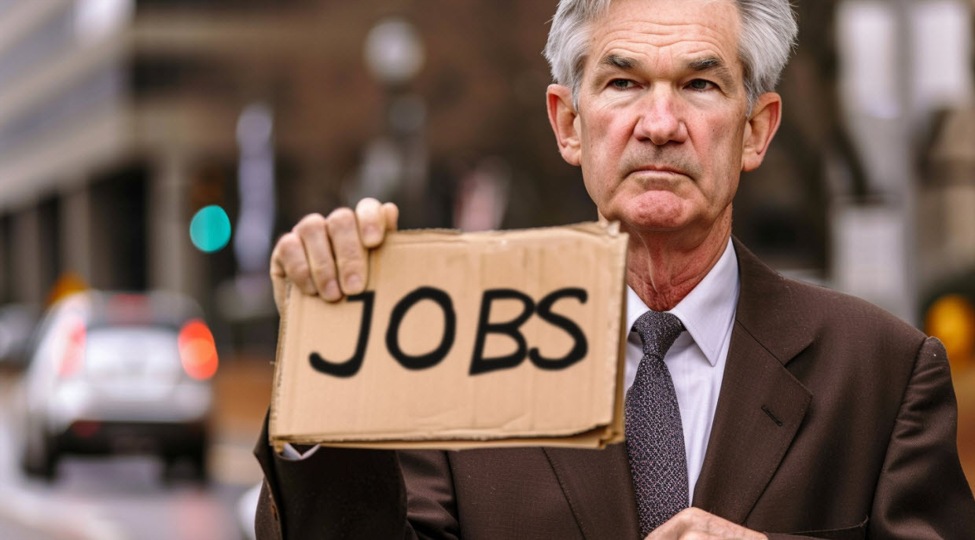

A loosening jobs market, at the margin, has prompted this from the Wall Street Journal:

- Weekend WSJ (Timiraos): “Case for September Rate Cut Builds After Slower Jobs Data”

The thoughts of a September Federal Open Market Committee (FOMC) rate cut sure do fit in with the election cycle …

This article was written by Eamonn Sheridan at www.forexlive.com.

Source link