Synopsis:

Goldman Sachs analyzes the recent sharp decline in USD/JPY and outlines a cautious approach to reengaging in long positions, anticipating potential stabilization around the 150 level.

Key Points:

-

Recent USD/JPY Movement:

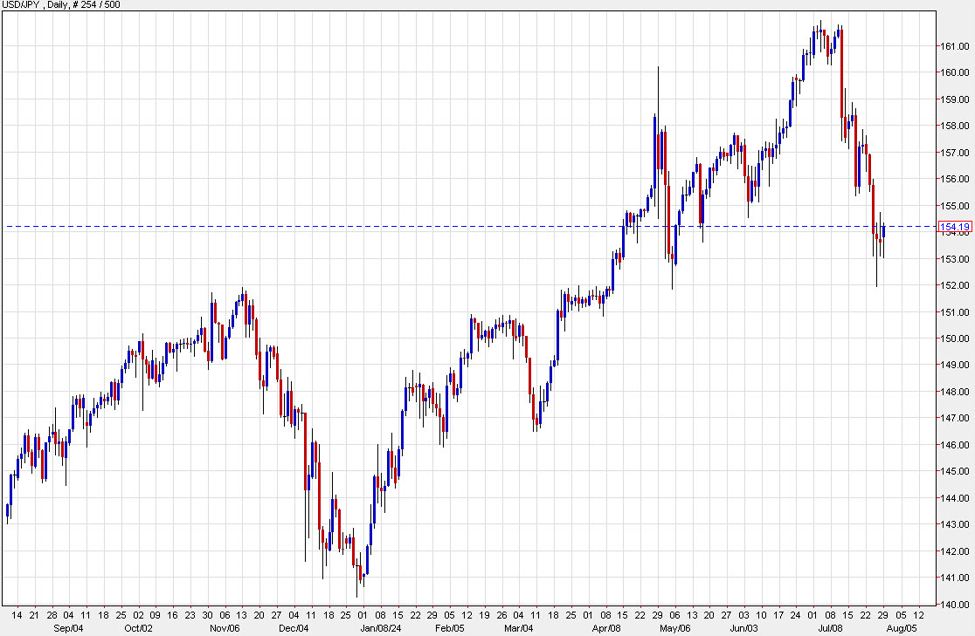

- Decline: USD/JPY has dropped nearly 10 big figures from its early July peak of almost 162.

- Factors: A combination of JPY-positive factors has driven this significant move.

-

Current Outlook:

- Avoiding Longs for Now: Despite the recent sharp decline, Goldman Sachs advises against taking long positions immediately.

- Support Level: The firm expects USD/JPY to continue moving back to the 150 level.

-

Factors Limiting JPY Appreciation:

- US Recession Risk: Sustained JPY appreciation seems limited without an increased risk of a US recession.

- Fed Response: A Fed willing to implement additional rate cuts would be necessary to support further JPY strength.

-

BoJ Policy Expectations:

- Potential BoJ Actions: Goldman Sachs economists expect the BoJ to hike rates and reduce JGB purchases, which could add further downward pressure on USD/JPY.

- Impact Assessment: Any impact from BoJ actions is likely to be short-lived unless the Fed unexpectedly cuts rates soon after, which is deemed unlikely.

-

Strategic Positioning:

- Long-Term View: Goldman Sachs maintains a 3-month forecast of 155 for USD/JPY, reflecting expectations of still-decent US growth and supported risk sentiment.

- Reengagement Timing: The firm is looking for opportunities to reengage in USD/JPY longs but prefers to wait for a more favorable entry point.

Conclusion:

Goldman Sachs remains cautious about reengaging in USD/JPY longs immediately, given the recent sharp decline and potential for further downward movement to the 150 level. However, they see limited scope for sustained JPY appreciation without increased US recession risk and further Fed cuts. The firm maintains a 3-month forecast of 155 for USD/JPY and will look for better opportunities to reengage in long positions.

For bank trade ideas, check out eFX Plus. For a limited time, get a 7 day free trial, basic for $79 per month and premium at $109 per month. Get it here.

This article was written by Adam Button at www.forexlive.com.

Source link