Fundamental

Overview

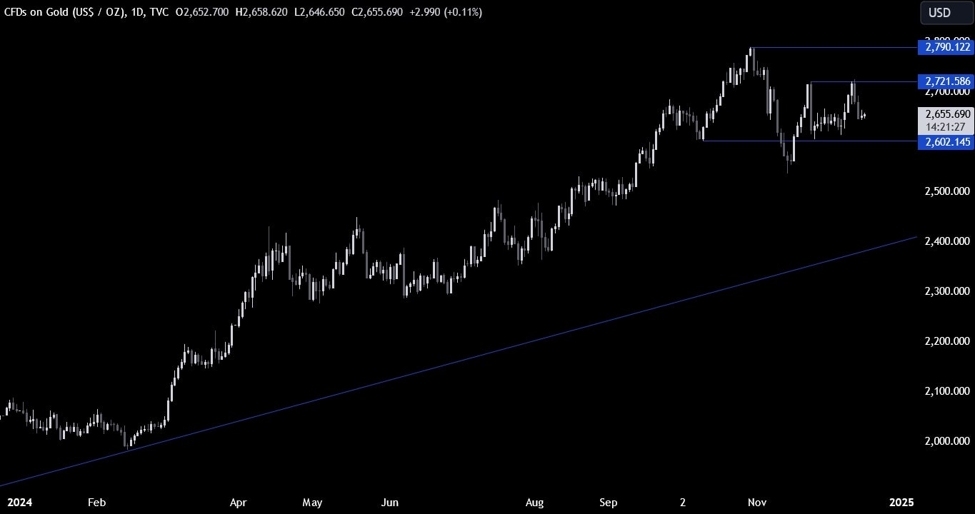

Gold dropped back inside

the previous range following some hotter than expected US inflation figures.

In the bigger picture, the

market’s pricing remains largely unchanged around three rate cuts by the end of

2025 but the rise in real yields is weighing on the market due to stronger

growth and stickier inflation expectations.

Moreover, tomorrow we have

the FOMC decision and although the central bank will likely match the market’s

pricing, we could have an overall hawkish event. The market participants might

want to err on the defensive side going into the event which could limit the

upside in gold.

Gold

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that gold dropped all the way back to the previous consolidation levels. We

have now a bigger range between the 2721 resistance

and the 2600 support. The market participants will likely continue to play the

range until we get a breakout on either side.

Gold Technical Analysis

– 4 hour Timeframe

On the 4 hour chart, we can

see that the price is now consolidating below the resistance of the previous

range. This is where we can expect the sellers to step in with a defined risk

above the resistance to position for a drop into the 2600 support. The buyers,

on the other hand, will want to see the price breaking higher to position for a

rally back into the 2721 resistance.

Gold Technical Analysis

– 1 hour Timeframe

On the 1 hour chart, there’s

not much else we can add here as the sellers will look for a drop from these

levels, while the buyers will look for a break to the upside to target the next

resistance. The red lines define the average daily range for today.

Upcoming

Catalysts

Today, we get the US Retail Sales data. Tomorrow, we have the FOMC Policy

Decision. On Thursday, we get the latest US Jobless Claims figures. On Friday,

we conclude the week with the US PCE data.

See the video below

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link