Fundamental

Overview

Nothing has changed in

terms of the fundamentals this week. In fact, gold continues to consolidate

around the major trendline and the 2600 support as the market awaits the US CPI

report next week before picking a direction.

In the bigger picture, the

trend remains bullish amid the Fed’s easing cycle, but the short-term corrections

will likely be triggered by the repricing in rate cuts expectations. For now,

the market looks fine with three rate cuts by the end of 2025 as the pricing

remained unchanged despite lots of strong US data.

Therefore, the next big

event for Gold will be the US CPI report. Higher than expected figures will

likely trigger another selloff, while lower than expected data should keep the

precious metal supported into new highs.

Overall, we shouldn’t

expect the same strong uptrend in gold going forward as we got used to in the

past couple of years as the conditions changed across the board.

In fact, the geopolitical

risk premium should ease with the Trump’s administration. Real yields might

either continue to fall slowly or just range for an extended period of time.

Last but not least, the new Treasury Secretary should reduce fears around the

US fiscal profligacy.

Gold

Technical Analysis – Daily Timeframe

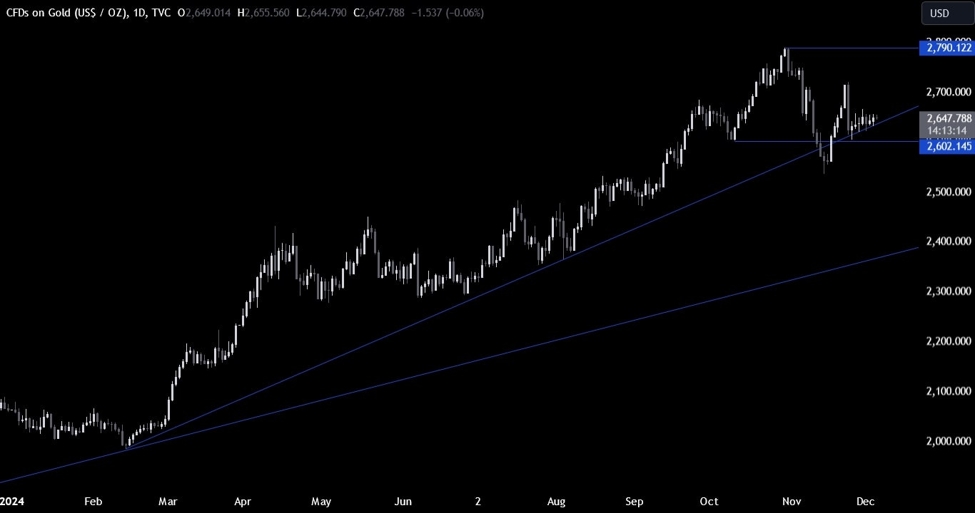

On the daily chart, we can

see that gold continues to consolidate around the major trendline. This is where the buyers keep on

stepping in to position for a rally into a new all-time high. The sellers, on

the other hand, will need the price to break below the trendline and the 2600 support to gain control and target a drop into the

next major trendline around the 2400 level.

Gold Technical Analysis

– 4 hour Timeframe

On the 4 hour chart, we can

see that the price is stuck in a range between the 2660 and 2620 levels. The

market participants will likely keep on playing the range until we get a

breakout on either side. On the downside though, we might get a fakeout if the

2600 support holds and the price rallies from there.

Gold Technical Analysis

– 1 hour Timeframe

On the 1 hour chart, there’s

not much else we can add here as the choppy price action will likely continue

until we get a strong catalyst with the US NFP tomorrow and the US CPI next

week in focus. The red lines define the average daily range for today.

Upcoming

Catalysts

Today, we

get the latest US Jobless Claims figures, while tomorrow we conclude the week

with the US NFP report.

See the video below

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link