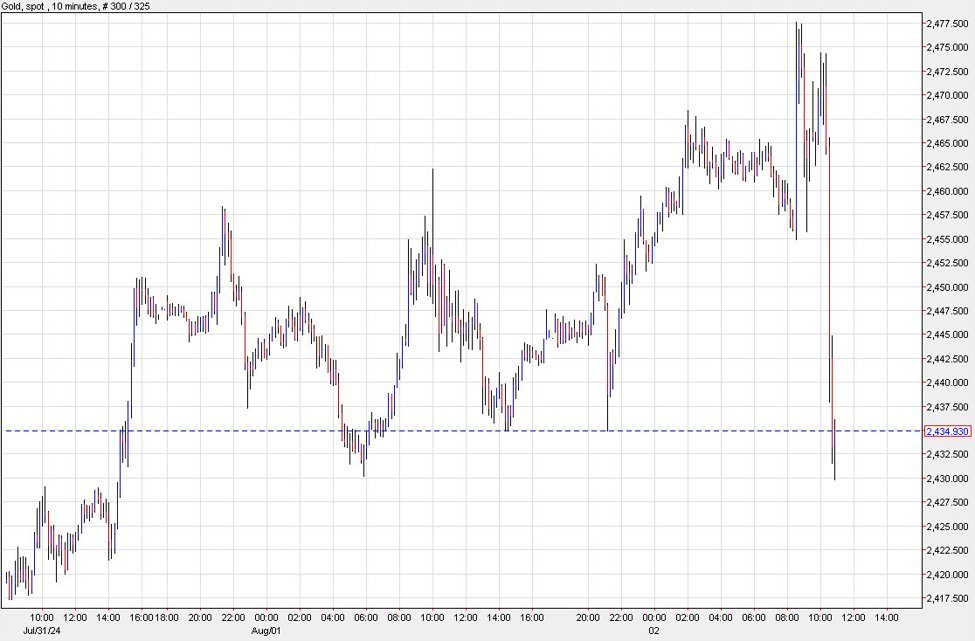

The problem with gold is that it’s a good asset to hold with things are moderately bad in markets. But when things get really bad, it gets sucked into the financial vortex. That’s what happened early in covid and that’s what is happening now (to a lesser extent). It was trading as high as $2477 in the aftermath of the FOMC decision but it’s quickly fallen to $2435 in the past 20 minutes.

The other problem for gold traders is the Middle East. Reports continue to circulate about an attack on Israel. There should be some comfort in the level that Iran is going to foreshadow the move, implying that it will be more about theatrics than revenge.

That said, there is always the chance of a miscalculation on either side and then we could have a real conflict.

At the moment though, the fear is subsiding somewhat.

Another problem is the technicals. It’s early but it looks like we could be getting a double top at $2475.

This article was written by Adam Button at www.forexlive.com.

Source link