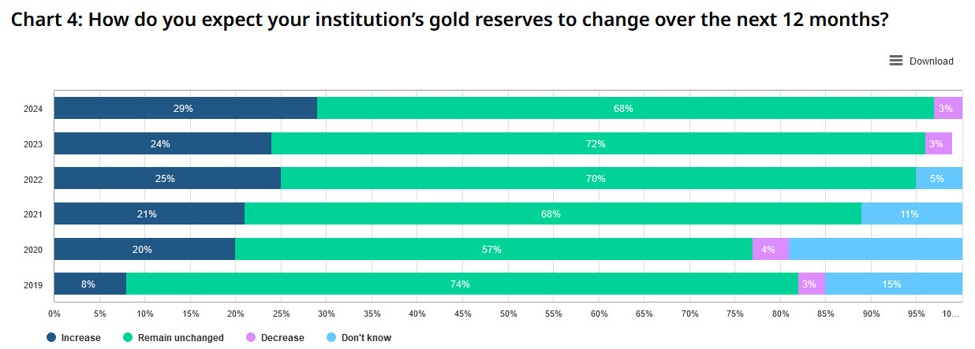

The World Gold Council surveys central banks each year on attitudes around gold and currency reserves. This year, 29% said they plan to increase holdings in the year ahead. That’s the highest since the survey began in 2018.

I think that’s even better than it looks because gold prices appreciated in the past year by almost 20%. That means that gold values as a portion of reserves have risen; which would normally mean less buying. Instead, they’re planning to increase holdings.

The survey also showed that managers expect rising portions of gold reserves in the coming years and lower holdings of US dollars.

With that, gold prices bumped $11 higher today to $2329 in a reversal of yesterday’s loss.

This article was written by Adam Button at www.forexlive.com.

Source link