Fundamental

Overview

The US Dollar has come back

under pressure recently as we got a couple of soft US data. The US ISM Manufacturing PMI disappointed the market as it came

lower than expected and the new orders index dropped further into contraction.

The US Job Openings yesterday showed some more cooling

as the data missed expectations by a big margin. The Treasury yields fell as a

consequence and weighed on the greenback.

In fact, the recent

appreciation of the GBP has been mostly driven by the US Dollar side of the

equation. From a monetary policy perspective, there’s now a 50/50 chance of

either a 25 or 50 bps cut at the upcoming FOMC meeting, so the NFP report

tomorrow will decide by how much the Fed is going to cut. For the BoE, the market sees a 75%

probability of no change at the upcoming meeting with a total of 42 bps of

easing by year-end.

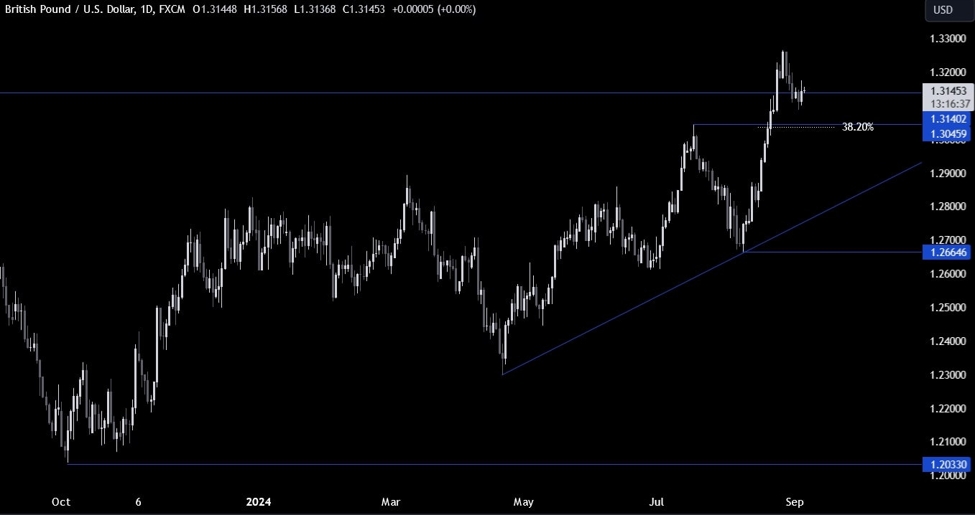

GBPUSD

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that GBPUSD eventually pulled back to the 1.31 handle where we got a bit of

a consolidation as we await the US NFP report tomorrow. If the price falls

below the recent low, we have a nice support

around the 1.3050 level where we can find the confluence

of the previous swing high and the 38.2% Fibonacci

retracement level.

That’s where we can expect

the buyers to step in with a defined risk below the level to position for new

highs. The sellers, on the other hand, will want to see the price breaking

lower to increase the bearish bets into the trendline.

GBPUSD Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see that the price broke above the minor downward trendline recently as the US

data came in of the softer side. This could be a signal of the end of the

pullback with new highs ahead but everything hinges on the US NFP report tomorrow.

GBPUSD Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see that we have a minor upward trendline defining the current bullish momentum

on this timeframe. We can expect the buyers to lean on the trendline to

position for new highs, while the sellers will want to see the price breaking

lower to pile in for a drop into the 1.3050 support. The red lines define the average daily range for today.

Upcoming

Catalysts

Today we have the US ADP, the US Jobless Claims and the US ISM Services PMI.

Tomorrow, we conclude the week with the US NFP report.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link