Fundamental

Overview

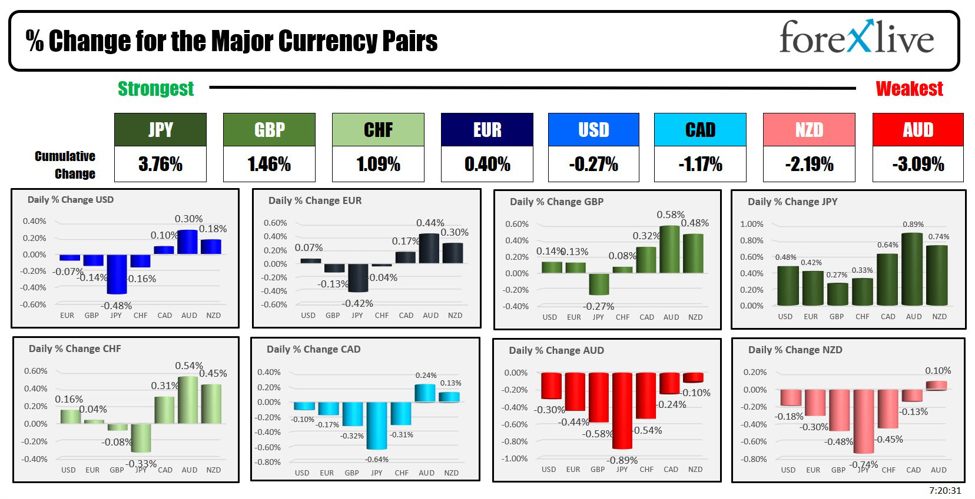

The USD last week lost

ground across the board following the soft US CPI report as the market priced back in two rate

cuts by the end of the year. The moves were reversed soon after though as we

got a bit more hawkish than expected FOMC decision where the dot plot showed that the Fed expected just one cut for

this year despite the soft US CPI report.

Fed Chair Powell backpedalled on the projections nonetheless making

them a bit less worrying as the central bank remains very data dependent. The

rally in the US Dollar eventually picked up steam as the risk sentiment turned

more cautious.

The GBP, on the other hand,

got pressured mainly because of the risk-off sentiment and the US Dollar

strength. If we go back into risk-on, we should see the greenback losing ground

against the Pound again.

This is also going to be an

important week for the Pound as we get the UK CPI and the BoE Policy Decision

where the central bank is expected to keep interest rates unchanged.

GBPUSD

Technical Analysis – Daily Timeframe

On the daily chart, we can

see that GBPUSD erased most of the gains since mid-May and dropped back into

the 1.26 region. The break of the trendline

and the 1.27 handle turned the bias more bearish with the first key support

level standing around the 1.2634 level.

This is where we can expect

the buyers to step in with a defined risk below the support to position for a

rally back into new highs with a better risk to reward setup. The sellers, on

the other hand, will want to see the price breaking further lower to increase

the bearish bets into the 1.25 handle next.

GBPUSD Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see that we have also the 38.2% Fibonacci retracement level of the entire rally since

April standing around the 1.2634 level which should technically strengthen the

support level. The buyers will need the price to rally back above the 1.27

handle to regain some conviction and start targeting new highs. For now, the

sellers remain in control.

GBPUSD Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see that the price is trading right in the middle of the two key levels. From a

risk management perspective, the sellers should wait for a pullback into the

1.27 handle where they will also find the confluence

of the 38.2% Fibonacci retracement level and the minor trendline.

The buyers, on the other

hand, will have a better risk to reward setup around the 1.2634 level but a

break above the 1.27 handle and the trendline might increase the bullish momentum

as the buyers will start to pile in. The red lines define the average

daily range for today.

Upcoming

Catalysts

Tomorrow we have the US Retail Sales and US Industrial Production. On Wednesday,

we have the UK CPI report. On Thursday, we have the BoE Policy Decision followed

by the US Housing Starts, Building Permits and the US Jobless Claims figures.

On Friday, we conclude the week with the UK Retail Sales, the UK PMIs and the US PMIs.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link