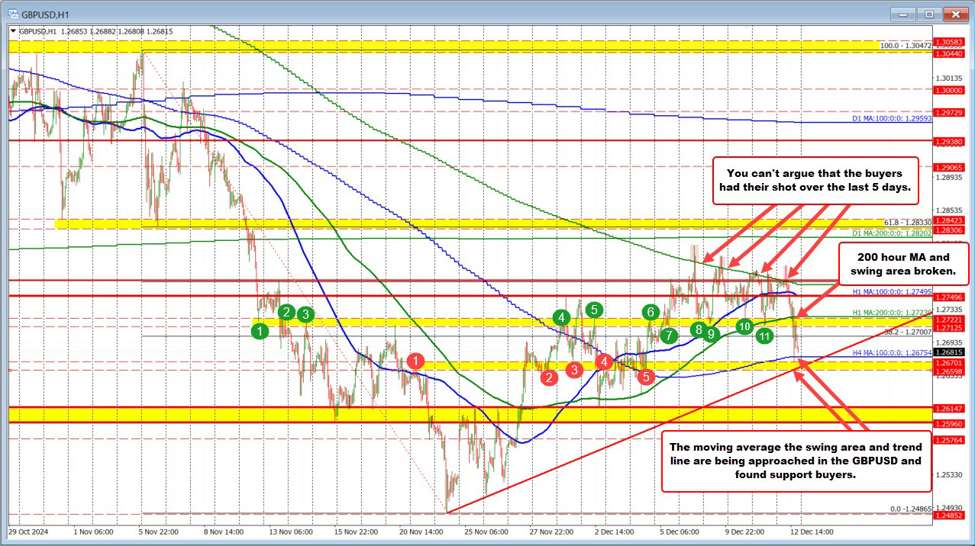

The buyers had their chances to push higher, but momentum failed to materialize. Over the past five trading days, the price moved above the falling 200-bar moving average (MA) on the 4-hour chart during four sessions. On the fifth day, the high for the session stalled precisely at the same MA. Notably, the last time the price held above this MA was October 3, and each breakout attempt in the recent sessions failed to generate sustained upside momentum.

Key Developments:

- Swing Area Retest: After yesterday’s decline, the price revisited the swing area defined by levels between 1.2712 and 1.2722, a region tested multiple times in recent sessions (Friday, Monday, and Tuesday). Buyers initially leaned here, prompting a bounce.

- Failed Breakouts: Today, the price failed to hold above both the 200-bar MA and the 50% retracement level, leading to further selling pressure.

- Downward Extension: The price broke below the 1.2712–1.2722 swing area, falling toward the 100-bar MA on the 4-hour chart and the lower swing area at 1.2660–1.2670, where buyers re-entered.

Current Technical Landscape:

- Bearish Scenario: The technical picture favors further downside if the price breaks below 1.2660–1.2670, increasing the bearish bias and inviting deeper probing.

- Bullish Scenario: A recovery above 1.2712–1.2722 would disappoint sellers and could reinvigorate buyers, reducing the bearish outlook.

- Critical Zone for Dip Buyers: The 1.2660–1.2670 area remains a key buying zone. Holding above this level would likely result in continued choppy price action between these key support and resistance levels.

The market is clearly respecting technical levels, with price action adhering closely to support and resistance zones. A decisive move below 1.2660 or above 1.2722 will likely determine the next directional bias.

This article was written by Greg Michalowski at www.forexlive.com.

Source link