Headlines:

- BOE leaves bank rate unchanged at 5.25%, as expected

- August back in the picture for the BOE?

- SNB cuts key policy rate by 25 bps to 1.25% from 1.50% previously

- SNB chairman Jordan: FX intervention can be in both directions

- Swiss franc falls as SNB continues with rate cuts

- ECB’s Knot: Optimal policy path is broadly in line with just under three rate cuts in 2024

- Japan top currency diplomat says there is no limit to FX intervention resources

- Germany May PPI 0.0% vs +0.3% m/m expected

- Switzerland May trade balance CHF 5.81 billion vs CHF 4.32 billion prior

Markets:

- AUD leads, CHF lags on the day

- European equities higher; S&P 500 futures up 0.4%

- US 10-year yields up 2.7 bps to 4.243%

- Gold up 0.5% to $2,340.17

- WTI crude up 0.1% to $81.70

- Bitcoin up 2.3% to $66,327

Central banks were in the spotlight in European trading today and they at least kept things interesting despite the decisions being as “expected”.

The SNB was the first up to bat and they decided to cut interest rates once again. The Swiss franc slipped in the aftermath though, with market expectations arguably leaning closer towards a 50-50 rather than a done deal.

But adding to that, SNB chairman Jordan was explicit in outlining that the franc has “significantly appreciated” in the past weeks. He also steered clear of mentioning what he did in May, that being “a weaker franc is the main source of inflation”. That suggests the central bank is comfortable with present levels in the currency.

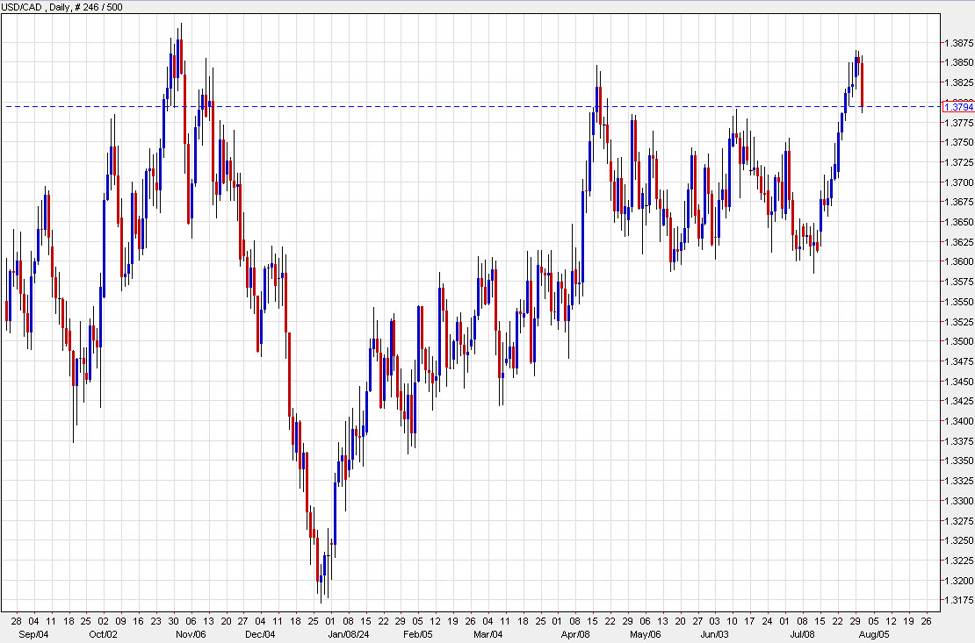

USD/CHF jumped from around 0.8840 to 0.8900 and is holding thereabouts now.

Then, we had the BOE decision which played out more or less as expected. However, the central bank dropped a couple of subtle dovish hints which might potentially draw an August rate cut back into the picture. I still think the bar for that is extremely high but there will be plenty of watchful eyes on the next UK CPI report on 17 July in any case.

The pound fell amid those considerations, with GBP/USD easing from 1.2705 to 1.2680 levels currently.

Looking to FX as a whole, the dollar continues to keep steadier on the week. EUR/USD is down 0.2% to 1.0720 while USD/JPY continues to creep higher in a push from 158.00 to 158.40 on the day.

In other markets, equities continue to keep up some optimism on the week awaiting the return of US markets later. European indices saw a bit of a setback yesterday but are seen bouncing back today.

This article was written by Justin Low at www.forexlive.com.

Source link