Headlines:

- USD/JPY pares gains on the day as risk flows weigh

- French stocks near the next key technical juncture amid a further drop today

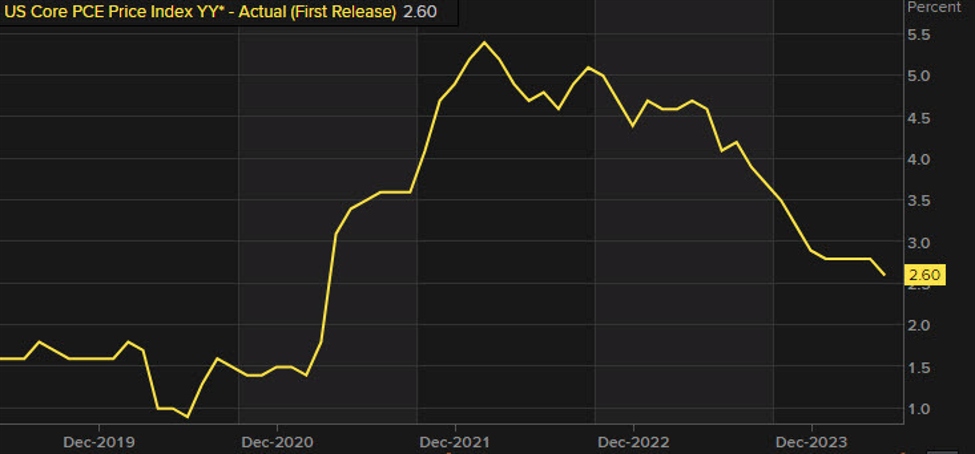

- The Fed’s preferred measure of inflation is expected to ease further

- BOJ governor Ueda: It is important to reduce JGB purchases in a predictable manner

- BOJ governor Ueda says will begin tapering bond purchases immediately after July meeting

- BOJ governor Ueda: The pre-announcement today is an exceptional measure

- BOJ governor Ueda: Will adjust rates if underlying inflation rises towards 2% target

- Japan’s Hayashi says will continue to closely monitor FX market

- ECB’s Vasle: rate cutting is likely to be slower than hiking was

- ECB’s Kazāks: Market expectations on rates are ‘reasonable’

- ECB’s Centeno: Disinflation process to resume after August

- France May final CPI +2.3% vs +2.2% y/y prelim

- Eurozone April trade balance €15.0 billion vs €20.0 billion expected

- China May M2 money supply +7.0% vs +7.2% y/y expected

Markets:

- CHF leads, NZD lags on the day

- European equities lower; S&P 500 futures down 0.4%

- US 10-year yields down 3.5 bps to 4.205%

- Gold up 1.2% to $2,331.17

- WTI crude up 0.1% to $78.68

- Bitcoin up 0.5% to $67,030

The session started with a focus on the Japanese yen, with markets taking to the more dovish decision by the BOJ to only pre-announce the tapering of their JGB purchases. The central bank said that they will only go into more detail on that in July, disappointing those expecting the decision to have come today instead.

USD/JPY was holding higher near 158.00, before extending gains to a high of 158.25 ahead of Ueda’s press conference. The pair lingered around 157.80-00 in the aftermath, before heavier risk flows weighed on market sentiment.

Equities sank while bond yields dropped as safety flows came into play and that dragged USD/JPY down to 157.00.

The dollar though, maintained a modest advance elsewhere with EUR/USD falling from 1.0720 to 1.0670. GBP/USD also fell from 1.2740 to 1.2695 before a mild bounce now to 1.2715 on the day.

The commodity currencies are the laggards as such, with AUD/USD down 0.2% to 0.6620 and NZD/USD down 0.5% to 0.6135 currently. The franc is the standout, with USD/CHF itself down 0.2% to 0.8920 on the day.

It looks like the unhealthy balance in the equities space is finally catching up to tech stocks. And that could spell for an ugly day to wrap up the week. In the bigger picture, this is very much a repeat of the runback from last month’s CPI report as well.

This article was written by Justin Low at www.forexlive.com.

Source link