- Federal Reserve speakers on Friday include Williams and Goolsbee

- AUD and NZD forecasts for 6 and 12 months out

- Japan’s finance minister Suzuki and Bank of Japan Governor Ueda press conference on Friday

- Australian data – March housing finance higher: Home loans +2.8% m/m (expected +1.0%)

- Bank of Korea Gov Rhee says US Treasury shared view that recent won weakness was temporary

- Here is what to watch for an extreme surprise in Friday’s US jobs report (NFP) (AND PMI)

- RBA meeting next week – preview – Cash rate to remain unchanged

- Reminder – Japanese and Chinese markets are closed for a holiday today

- Morgan Stanley warn of a falling GBP, citing Fed – BoE policy divergence risk

- HSBC cuts their Fed forecast to 25bp this year, from 75bp previously

- Australian April Services PMI (Final) 53.6 (prior 54.4)

- ICYMI – BOJ data suggests significant additional yen-buying intervention this week

- ECB’s Stournaras says three rate cuts this year is probable

- Q1 gold demand strong, driven by China

- Goldman Sachs says its ‘base case’ gold forecast is USD 2700 by the end of 2024

- JP Morgan is looking for OPEC+ to extend its output cuts into H2 of this year

- ECB’s Lane on what it’ll take for the Bank to dial back high rates

- Here’s a forecast for USD/JPY to 165 ICYMI

- Apple EPS $1.53 versus $1.50 exp. Revenues $90.75 billion versus 90.01 billion exp

- Jack Dorsey’s Block says it will buy bitcoin every month with 10% of its gross profit

- ECB’s Lane says the Bank is not pre-committing to a particular rate path – data dependent

- US stocks close solidly higher led by Nasdaq/Russell 2000

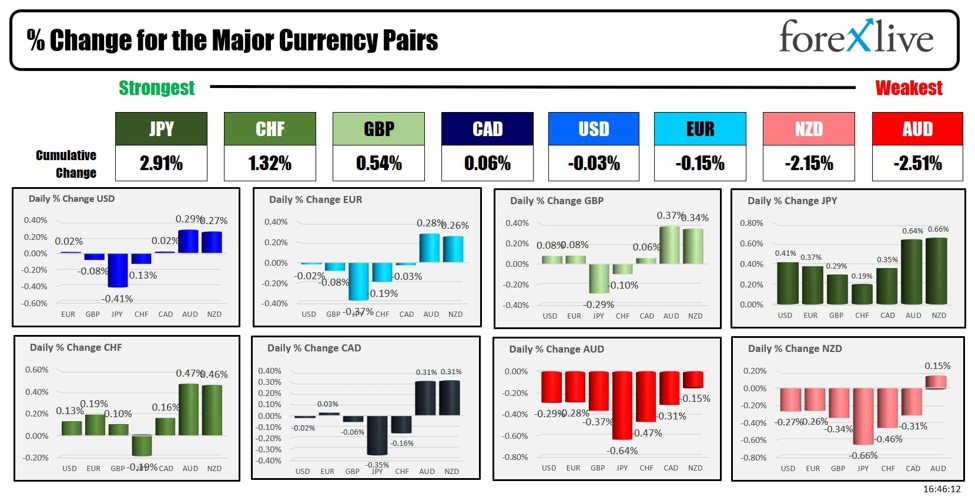

- Forexlive Americas FX news wrap: USD/JPY falls back to 153

- Trade ideas thread – Friday, 3 May, insightful charts, technical analysis, ideas

After

its losses during US trade the USD slid a little further during the

Asian session. The ranges were smaller, but the USD gained ground

across the majors board. After a solid bounce from 153.00 to 153.70

or so USD/JPY dropped back to 153.00 and spent an hour or so

straddling the big figure before finally breaking down to around

152.75. Its just above 153.00 again as I update. No intervention was sighted

today, but do be aware that Japan’s finance minister Suzuki and Bank

of Japan Governor Ueda will hold a press conference on the sidelines

of the ADB meeting at 1345 GMT / 0945 US Eastern time.

On

the data front the flow of info was light. Housing

finance data

from Australia rose, to a 19 month high.

European

Central Bank chief economist Lane spoke (virtually) at an event on

the US west coast. He didn’t mention a June rate cut. He did say

that as the data points to inflation returning toward target the more

the Bank will be able to remove its restrictions.

Bank

of Korea Governor Rhee spoke, I read his comments as having

implications for the Bank of Japan (see bullets above for detail).

It’s

a packed agenda for the balance of Friday, but have a great weekend

after it all everyone!

***

Bitcoin inched higher too:

This article was written by Eamonn Sheridan at www.forexlive.com.

Source link