- Federal Reserve speakers today include Barkin, Collins, Kugler, Musalem, Logan, Goolsbee

- US data focus for Tuesday – May retail sales – the range of expectations to watch

- Bank Japan Gov Ueda: Must be vigilant to impact of weak yen, import price moves on economy

- ECB Vice President Luis de Guindos is speaking on Tuesday

- NZD traders heads up – RBNZ Chief Economist Paul Conway is speaking on Wednesday (NZ time)

- Bank of Japan Governor Ueda says chance we could raise interest rates at July meeting

- Japan finance minister Suzuki – Interest rates are set by markets

- PBOC sets USD/ CNY mid-point today at 7.1148 (vs. estimate at 7.2494)

- Bank of Japan Gov Ueda expects strengthening in Japan wage-price cycle – higher inflation

- Fed’s Cook speech – does not comment on US economy or monetary policy

- Singapore’s May non-oil domestic exports down 0.1% y/y (vs. expected -1.0%)

- A projection for “wider and higher ranges for AUD in the month ahead”

- JP Morgan’s Kolanovic stays bearish. Actual traders at JPM ignoring him, see SPX higher.

- HSBC expect the USD/CNY reference rate to drift higher (yuan weaker)

- RBA speech coming up @0010 GMT (2010 US Eastern time) – unlikely to move AUD

- Citi downgrades European equities, cites 3 reasons. Upgrades its view on US equities.

- Nomura warn of yen intervention – also see risk of a BoJ rate hike at its next meeting

- Bloomberg: Trading Indicator With 100% Win Rate Signals Sell Long Bonds Now

- US markets closed for Juneteenth on Wednesday, June 19th – market hours impact

- New Zealand data – Q2 consumer confidence falls to 82.2 from 93.2 in Q1

- Forexlive Americas FX news wrap 17 Jun:The USD is mixed/stocks higher despite higher rates

- Reserve Bank of Australia preview – straight forward decision, on hold with a neutral bias

- Another day, another record: US stocks start soft and then surge

- Trade ideas thread – Tuesday, 18 June, insightful charts, technical analysis, ideas

News

and data flow during the session here was light.

We

did have ongoing comments from Bank of Japan Governor Ueda, who was

answering questions in the Diet (Japanese parliament) again today.

The comment that hit the headlines was Ueda saying the BoJ could

raise interest rates next month depending on economic data available

at the time. The meeting in July is on the 30th

and 31st.

Ueda also said (he said a lot, but notably …) that higher import

costs from the weak yen may negatively impact household spending, but

he added that increasing wages will help underpin consumption and he

expected the economy to remain on track for a moderate recovery.

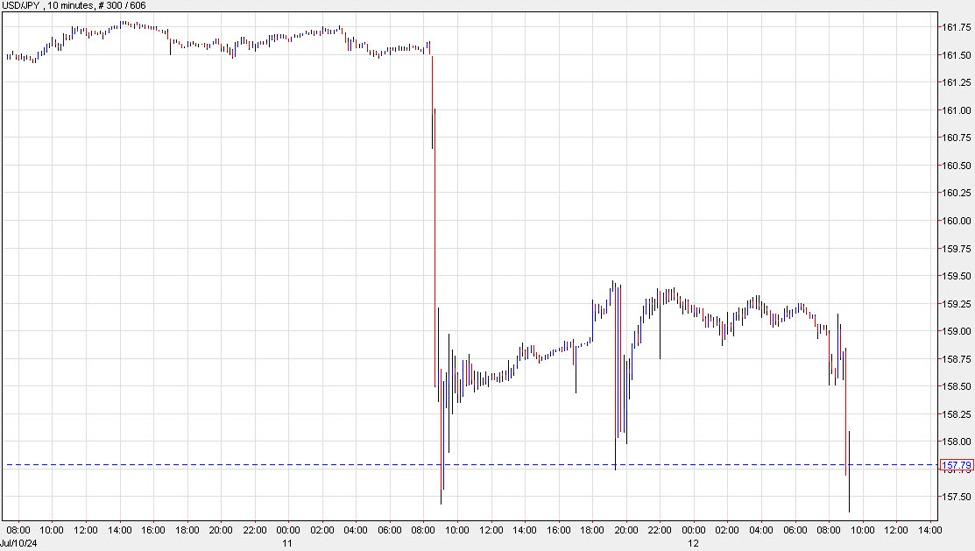

On

balance his comments were yen-supportive, but during it all USD/JPY

has not moved much. From highs earlier around 157.75 it fell to just

under 157.55 and it is more or less centred in that small range as I

post.

EUR/USD

moved higher early, to just over 1.0740 but subsided to be just above 1.0720 as I post. Yes, not a larger range at all.

AUD,

NZD, GBP, CAD followed similar patterns, all are near their (small

range) session lows as I update. Ahead for the Australian dollar is

the Reserve Bank of Australia statement due at 0430 GMT (0030 US

Eastern time) with Governor Bullock’s press conference following an

hour later. The Bank is widely expected to remain on hold and to keep

its options open on rates depending on incoming data (sticky

inflation above the Bank’s 2-3% target band is the biggest

challenge for the RBA at present).

Still

to come on Tuesday are US retail sales data for May followed by a

half-dozen Federal Reserve officials speaking. It’s a holiday in

the US on Wednesday so it seems they are lining up to get noticed

before the mid-week break.

AUD/USD ahead of the imminent Reserve Bank of Australia statement:

This article was written by Eamonn Sheridan at www.forexlive.com.

Source link