Following yesterday’s move lower, US equity futures have attempted to put in a marginal bounce of their lows from yesterday. Traders will have to wait for the US cash open with eyes on Nvidia to see whether that will be sustained.

Forex has traded fairly mixed today with the JPY leading while the USD the laggard, and overall price action showing more noise than signal on the risk sentiment side.

Commodities are mixed as well with mostly marginal moves across energy and base metals, while gold has come under a bit of pressure.

It’s worth noting that this week is month-end, quarter-end and half-year end, which means price will be susceptible to distortions from possible rebalancing flows. Which means be careful of any strange flows you see as it might not be driven by any specific catalysts.

Good luck out there.

- USD remains on the backfoot while JPY leads the majors

- China Premier Li says confident and capable to achieve growth target of around 5%

- Goldman expects USD upside under a Republican victory

- Japan chief cabinet sec doesn’t comment on FX levels

- PBoC injects 300 billion yuan via 7-day reverse repose

- USDCNH pops higher after weakest PBoC mid-point fix since Nov 2023

- PBOC sets USD/ CNY reference rate for today at 7.1225 (vs. estimate at 7.2587)

- BofA expects a Dec rate cut from Fed

- Australia consumer sentiment 1.7 vs -0.3 prior

- PBOC is expected to set the USD/CNY reference rate at 7.2587

- Japan to revise GDP (Jan-Mar) due to corrected construction orders data

- Biden admin to investigate China Telecom, China Mobile and Chin Unicom

- Japan Services PPI 2.5 vs 2.8 prior

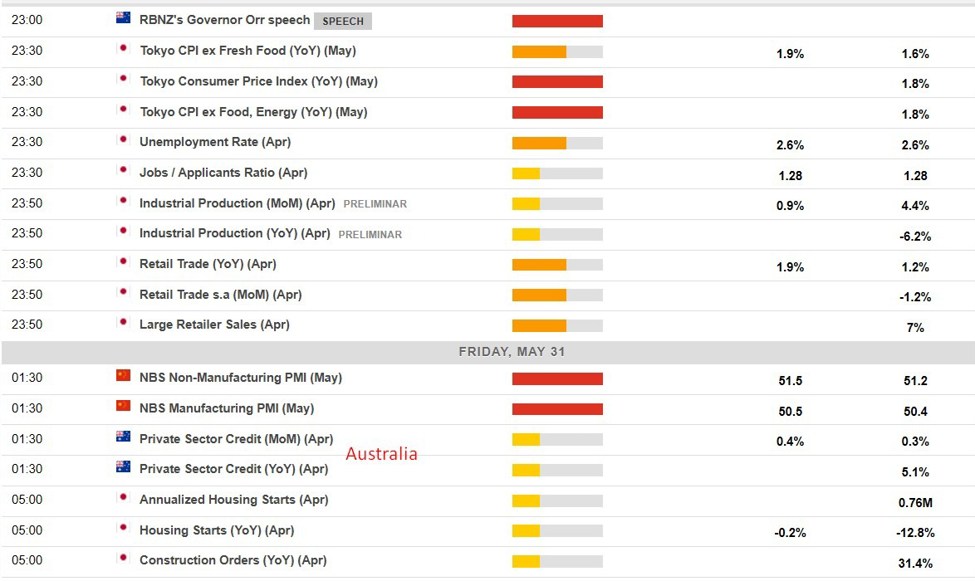

- Today’s economic calendar

- Downside potential in play for GBPNOK?

- Interesting strength for EUR at the start of the week

- The cover model for AI took a bit of a break

- EUR strongest and USD the weakest getting closer to Asia-Pac

This article was written by Arno V Venter at www.forexlive.com.

Source link