- US July CPI +2.9% vs +3.0% y/y expected

- EIA weekly crude oil inventories +1357K vs -2200K expected

- US MBA mortgage applications w.e. 9 August +16.8% vs +6.9% prior

- Eyes on the whales with 13F filings due

Markets:

- S&P 500 up 0.4%

- WTI crude oil down $1.19 to $77.16

- US 10-year yields down 2.1 bps to 3.83%

- Gold down $18 to $2445

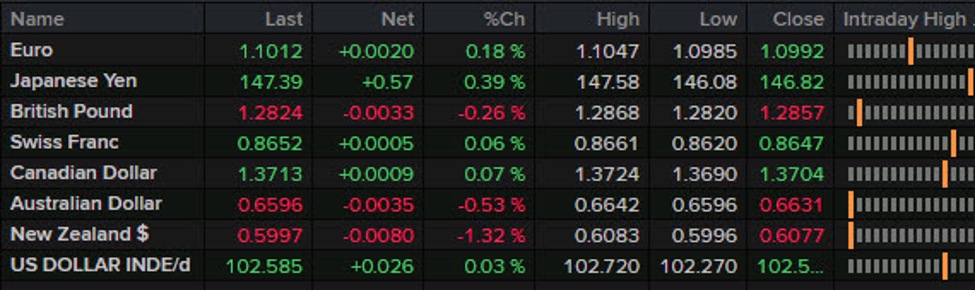

- EUR leads, NZD lags

The CPI report was a touch softer than estimates and the small inflation was largely driven by housing, which has some downward pressure in the pipeline. There was a time when a report like that would have led to a massive market reaction but it was extremely limited today, reflecting:

- Investors moving beyond inflation

- Something of a front-run of the report after yesterday’s PPI

The latter dictated the market reaction initially, with USD strengthening and bonds selling off. But the sell-the-fact trade was lacklustre and the overriding theme was stock buying, bond buying and a mixed bag for the US dollar. USD/JPY chopped in a 100 pip range immediately after the report before settling up 50 pis, then slowly giving it all back, then climbing again late near the highs of the day.

The late buying in the dollar was a puzzle given lower yields and higher stocks. Tomorrow we get retail sales data so that is certainly keeping markets on edge.

We could also be seeing more negative bets on global growth as oil prices gave back all the weekly gains but the evidence of that is limited. Overall, it was one of the few days this summer that felt like a summer market, with newsflow limited.

This article was written by Adam Button at www.forexlive.com.

Source link