- NASDAQ closed at new record levels each day of this trading week

- US Sen Warren seeks to assemble a group of Democratic senators to ask Biden to exit race

- Key events and releases for traders in the upcoming trading week

- Crude oil futures settle at $83.16

- Geopolitics: Head of Israel’s Mossad returned from Doha after initial cease-fire meetings

- Baker Hughes oil rig count 479 unchanged on the current week 101

- New York Fed Nowcast growth estimate for Q2 falls to 1.8% down from 1.93% last week

- European equity close: French stocks cautious ahead of Sunday’s vote

- SNB’s Jordan “relatively comfortable” with inflation

- Fed mon pol report: Labor supply-demand balance resembles pre-pandemic period

- Rachel Reeves becomes Britain’s first female Chancellor

- Timiraos: The Fed may start the debate about a Sept cut at the upcoming meeting

- Putin: We see Orban’s visit as an attempt to restore the dialogue

- Canada June PMI 62.5 vs 52.0 expected

- The gold market may have found a second leg

- Kickstart the FX trading day for July 5 w/a technical look at the EURUSD, USDJPY & GBPUSD

- US dollar chops after non-farm payrolls

- Canada June employment change by -1.4K versus 22.5K estimate

- US May non-farm payrolls +206K vs +190K expected

- The JPY is the strongest and the USD is the weakest as the NA session begins

- What are the Fed odds saying ahead of the jobs report later?

- ForexLive European FX news wrap: On to the NFP next

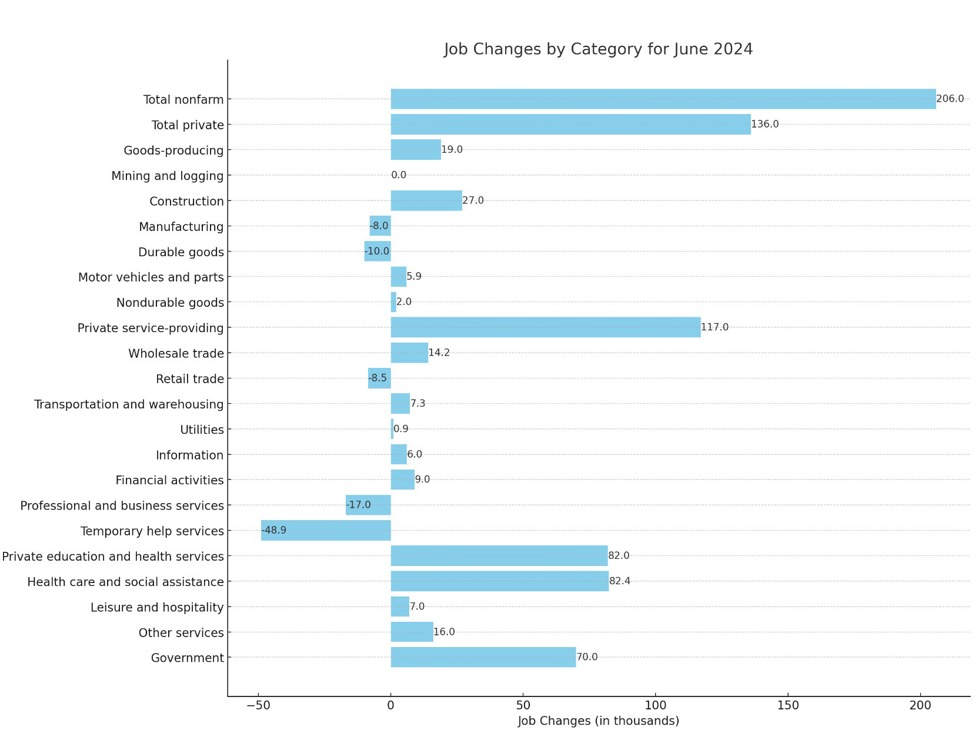

The US jobs report showed Non-Farm Payroll up a greater than expected 206K vs 190K estimate. However, the details of the report were less than stellar.

- Revisions to prior 2 months was -111K. That more than offset the above expected growth this month.

- The unemployment rate moved to 4.1%. The highest rate since November 2021

- Average hourly earnings YoY came in at 3.9% which is the lowest level June 2021

- The gain in Non-farm payroll was helped by a large 70 K rise in government jobs private education and health also added 82K. The two sectors accounted for 74% of the total gain for the month

- Temporary help fell -48K which is indicative of a slowing job market

- Professional and business services fell -17 K

- Leisure and hospitality – a strong job grower in the post pandemic recovery and indicative of discretionary spending – rose only 7K .

Below is a summary of the jobs data:

The initial reaction in the forex market was the dollar moving higher, but those gains were quickly reversed as yields also reversed to the downside.

The USD is ending the day as the 2nd weakest of the major currencies behind the CAD. The largest declines were versus the GBP (-0.45%), the CHF (-0.49%) and the NZD (-0.48%).

In the US debt market, yields moved lower with the shorter end moving the most as traders increased the expectations for rate cuts in September and through the end of the year.

Looking at the yield curve, a snapshot shows:

- 2-year yield 4.605%, -8.7 basis points

- 5-year yield 4.226%, -8.3 basis points

- 10-year yield 4.278%, -6.9 basis points

- 30-year yield 4.475%, -4.4 basis points

For the trading week yields were solidly lower as well with :

- 2-year yield down -14.8 basis points

- 5-year yield down -14.9 basis points

- 10-year yield down -11.8 basis points

- The 30-year yield down -8.0 basis points

The declining yields also helped to push stocks higher and complete a week that saw the NASDAQ index close at record levels for each day the holiday shortened week.

- Dow Industrial Average average rose 0.17%.

- S&P index rose 0.55%.

- NASDAQ index rose 3.5%, its best week since April 22

Despite the sharp rise in broader stock indices, bitcoin had a horrible week on by nearly $6000 to -$56,718 currently.

Crude oil prices did rise by $1.62 or 1.99% despite being lower today by $0.72 for -0.86%.

This article was written by Greg Michalowski at www.forexlive.com.

Source link