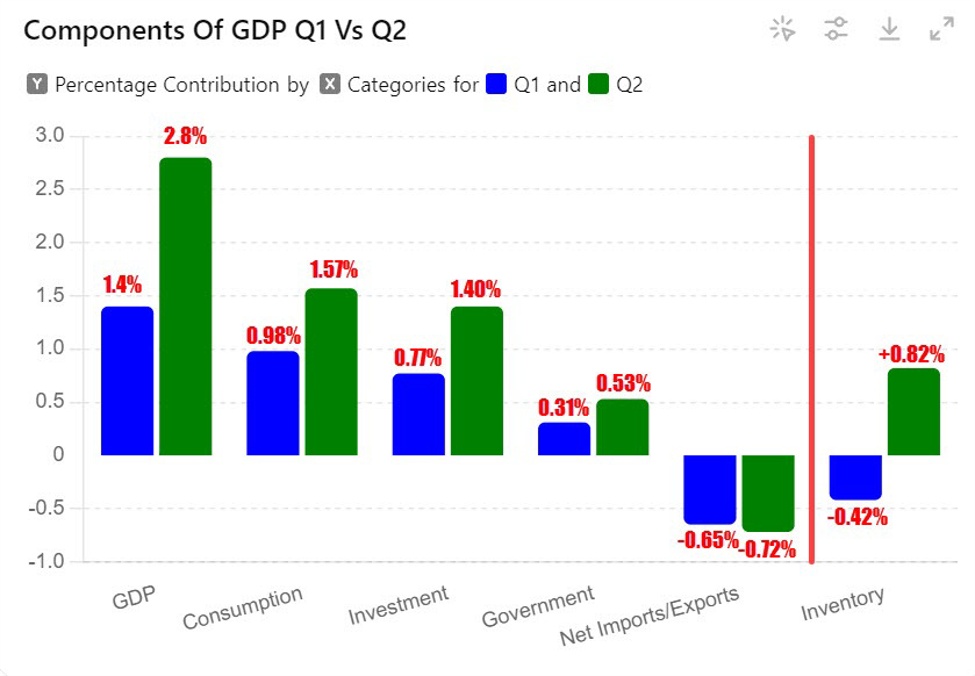

The GDP data in the Q1 came in at 1.4%. Today we learned the advanced GDP for Q2 came in at 2.8%.

If you looked at the component contributors or subtractions from the total GDP number:

For Q1:

- Consumption +0.92%.

- Investment, +0.77%

- Government, +0.31%

- Net imports/exports -0.65%

The sum comes to the GDP of 1.4%

For Q2:

- Consumption, +1.57%.

- Investment, +1.40%.

- Government, +0.53%.

- Net imports/exports, -0.72%

The sum of those components comes to GDP of 2.8%

Now, within the investment component is inventory. Inventories can fluctuate up and down and indeed they did swing from a negative contributor in Q1 (-0.42%) to a positive contributor (+0.82%) in Q2.

What if the GDP numbers for each was adjusted for the inventory swings?

Inventories in the Q1 subtracted -0.42% from the GDP. If that is added back, the growth ex inventories comes at around 1.8% in Q1.

For Q2, if you were to subtract the inventory gain of 0.82% from the total 2.8% gain, the GDP would be just below 2.00%

So combining the two quarters GDP ex the inventory, the growth comes in around 1.9% which is about the trend growth.

Soft landing?

The Fed may look at it that way vs the Q2 is twice as strong.

This article was written by Greg Michalowski at www.forexlive.com.

Source link