Fundamental

Overview

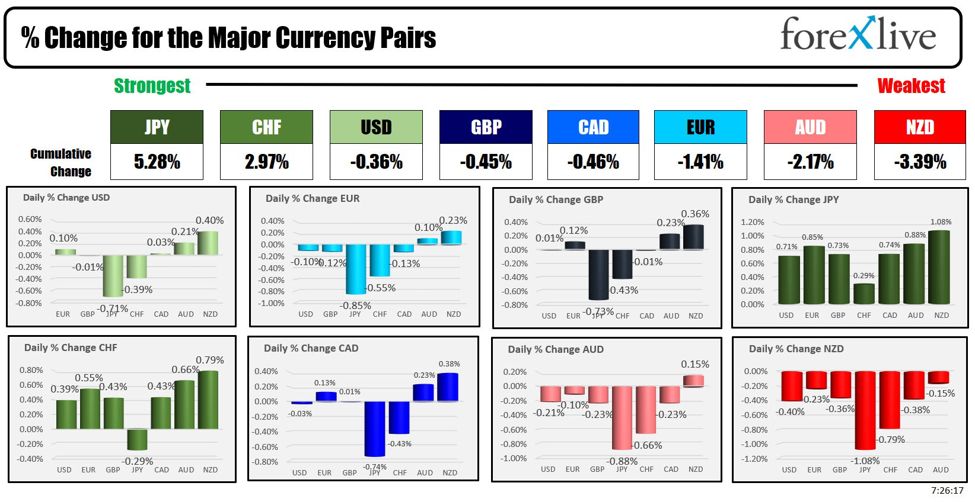

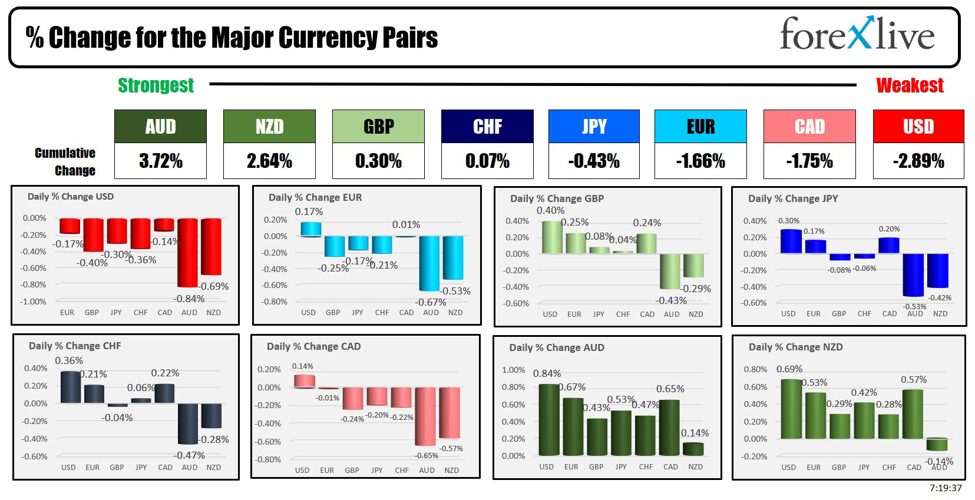

The USD has been rallying

steadily against the major currencies since last Wednesday on the back of

general risk-off sentiment, although it’s unclear what has triggered the move.

From the monetary policy perspective, nothing has changed as the market

continues to expect at least two rate cuts by the end of the year and sees some

chances of a back-to-back cut in November.

The data continues to

suggest that the US economy remains resilient with inflation slowly falling

back to target. Overall, this should continue to support the soft-landing

narrative and be positive for risk sentiment. The new driver could be Trump now

looking more and more like a potential winner and his policies are seen as

inflationary which could see the Fed eventually going even more slowly on rate

cuts.

The EUR, on the other hand,

has been supported against the US Dollar in the past weeks mainly because of

the risk-on sentiment, although that has changed last week. On the monetary

policy front, the ECB members continue to repeat that they will wait for the

data throughout the summer before deciding on a rate cut in September.

EURUSD Technical

Analysis – Daily Timeframe

On the daily chart, we can

see that EURUSD couldn’t extend into the 1.10 handle, and as the price fell

back below the 1.09 handle, the sellers piled in more aggressively with the 1.0812

support now being in sight.

That’s where we can expect

the buyers to step in with a defined risk below the level to position for a

rally into the 1.10 level. The sellers, on the other hand, will want to see the

price breaking lower to increase the bearish bets into the 1.0727 level next.

EURUSD Technical

Analysis – 4 hour Timeframe

On the 4 hour chart, we can

see that we have a minor downward trendline defining the current bearish momentum.

We can expect the sellers to lean on it with a defined risk above it to

position for a break below the 1.0812 support with a better risk to reward

setup. The buyers, on the other hand, will want to see the price breaking

higher to gain some control and start targeting new highs.

EURUSD Technical

Analysis – 1 hour Timeframe

On the 1 hour chart, we can

see that we have some consolidation at the 1.0850 level. This is where the

sellers will look for a rejection and a drop into new lows, while the buyers

will want to see a break above the trendline. The red lines define the average daily range for today.

Upcoming

Catalysts

Today we will get the latest US Jobless Claims figures and the US Q2 Advance

GDP. Tomorrow, we conclude the week with the Tokyo CPI and the US PCE reports.

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link