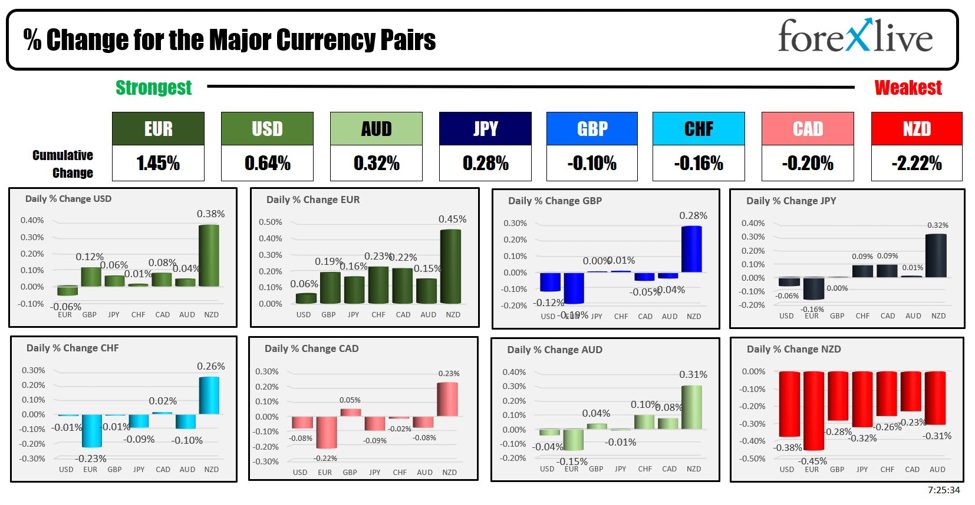

The USD weakened

across the board recently due to a more dovish than expected FOMC decision last

week where the Fed decided to signal a bigger QT taper beginning in June and

the Fed Chair Powell pushing back repeatedly against rate hike expectations.

Moreover, the data on Friday showed that the Fed might indeed just keep rates

higher for longer as job and wage growth soften.

The EUR, on the

other hand, has been gaining ground mainly because of the USD weakness and some

positive news on the growth side as the PMIs

continue to improve. The market has already fully priced in three rate cuts for

the ECB this year, so that shouldn’t weigh much on the EUR anymore. The market

will need something to give it a reason to price in a change in the Fed’s or

ECB’s monetary policy to trigger another sustained move.

EURUSD

Technical Analysis – Daily Timeframe

On the daily

chart, we can see that EURUSD spiked into the key trendline

around the 1.08 handle following the soft US NFP report. The price eventually

got rejected from the trendline and the market faded the spike as the data didn’t

change much and we still have the US CPI risk ahead. The sellers will likely

keep piling in around these levels to position for a drop into new lows, while

the buyers will want to see the price breaking to the upside to increase the

bullish bets into the 1.09 handle.

EURUSD

Technical Analysis – 1 hour Timeframe

On the 1 hour

chart, we can see that from a risk management perspective, the buyers will have

a much better risk to reward setup around the 1.0727 level where we can find

the confluence

of the upward minor trendline

and the 61.8% Fibonacci

retracement level. The sellers, on the other hand, will want to see the

price breaking to the downside to invalidate the bullish setup and increase the

bearish bets into new lows.

Upcoming

Catalysts

This week is pretty empty on the data front with just the US

Jobless Claims on Thursday and the University of Michigan Consumer Sentiment

survey on Friday being the only notable releases left. It’s unlikely that they

will change the market’s expectations that much though, so the price action

might remain tentative heading into the US CPI next week, although the bias might

remain generally bullish because of the risk-on sentiment.

See the video below

This article was written by Giuseppe Dellamotta at www.forexlive.com.

Source link