-

Lowered the deposit facility rate by 25 basis points

-

Decreased the interest rates on main refinancing operations to 3.65%

-

Decreased the marginal lending facility rate to 3.90%

-

Changes took effect on September 18, 2024

-

Headline inflation to average 2.5% in 2024, 2.2% in 2025, and 1.9% in 2026

-

Core inflation to decline from 2.9% in 2024 to 2.3% in 2025 and 2.0% in 2026

-

Economy to grow by 0.8% in 2024, 1.3% in 2025, and 1.5% in 2026

-

Governing Council to maintain restrictive policy rates until inflation reaches 2% target

-

Data-dependent and meeting-by-meeting approach to determining policy rates

-

APP portfolio to decline at measured pace

-

PEPP portfolio to decrease by €7.5 billion per month on average

-

Reinvestments under PEPP to discontinue by end of 2024

The ECB did cut rates by 25 basis points as expected. A summary shows:

Interest Rate Changes:

Inflation Projections:

Economic Growth:

Monetary Policy:

Asset Purchase Programme:

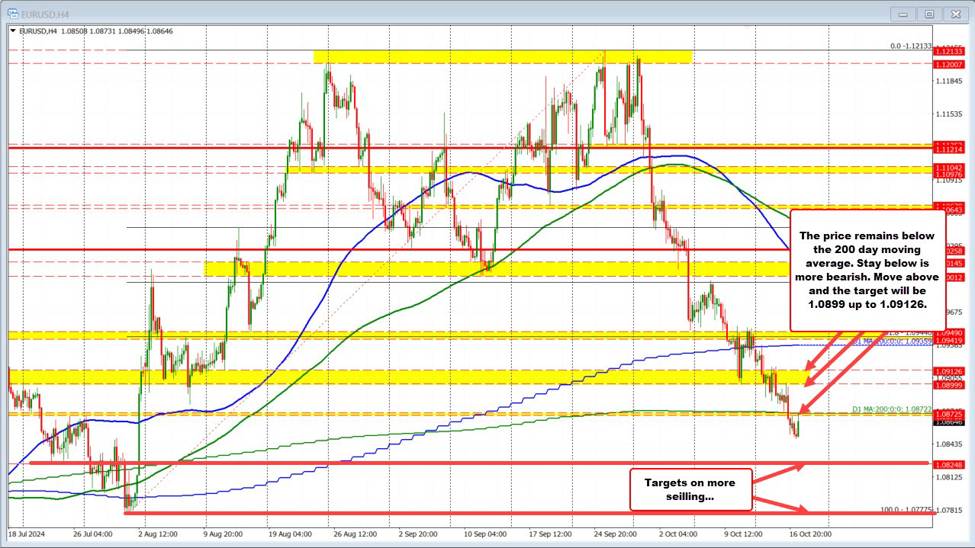

Technically, the EURUSD fell below the 200 day moving average yesterday. That moving average currently comes in at 1.08722. The high price today has reached 1 .08731 right near that level. Sellers leaned keeping the bearish bias.

For today, the 200 day moving average will be the barometer for short-term technical bias. If the price starts to try back above that level we could see further upside corrective probing with resistance at 1.0899 up to 1.09126. Alternatively stay below and the bias remains to the downside with targets at 1.08248 and the August low at 1.0777..

This article was written by Greg Michalowski at www.forexlive.com.

Source link