The EURUSD has been trending lower since peaking in mid-September. Rates moved higher. The markets seem to be pricing in a Trump victory with higher deficits/higher inflation from tariffs and tax cuts.

Later this week – ahead of the eletion the US jobs report, the most recent PCE data will be released. Next week in addition to the election, the US Fed will meet. Finally, there is a slew of earnings releases as well with Apple, Amazon, Meta, Microsoft Alphabet just some of the names reporting.

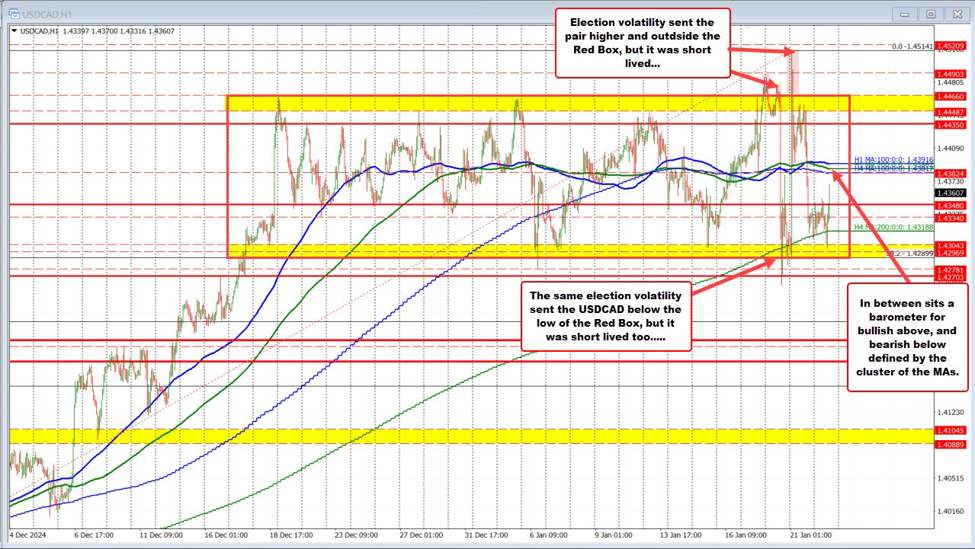

With so much uncertainty, the EURUSD seems to be defining a safe-zone where it can part itself. That safe-zone admittedly has a dollar bullish bias (the EURUSD is at lows going back to July), but there is a floor. There is a ceiling.

- The floor area is at a swing area going back to May 2024 and comes between 1.07609 and 1.07767.

- The ceiling area is near 1.0873 where the 200 day MA, the 100-bar MA on the 4-hour chart and a swing area is found.

That area has confined the pair over the last couple weeks of trading.

In between traders are using the 1.0810 level as a intermediate swing/bias defining level.

This red box area will help to define bullish and bearish bias going forward.

- If there is a break lower below 1.0766, it opens the downside for more selling potential.

- Conversely, a move back above 1.0810 could lead to a revisit to the high of the swing area at 1.0873 and if broken would open the door for more upside.

In between watch 1.0810 as a rudder for the bullish above/bearish below ship in the short term.

This article was written by Greg Michalowski at www.forexlive.com.

Source link