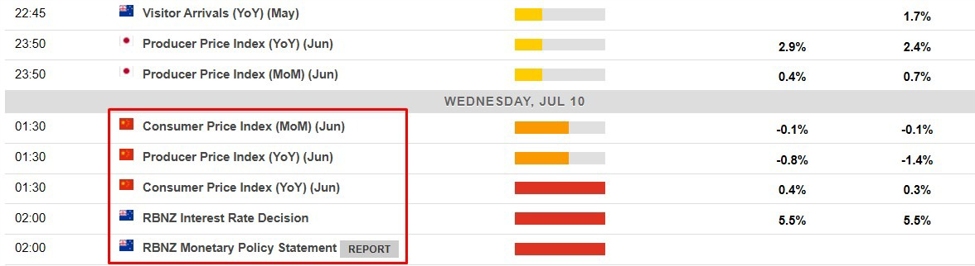

Chinese inflation is expected to have edged up a little further in the June data due today. It should put to rest the fear of slipping back into deflation, at the CPI level at least. The PPI is still deep in a deflationary hole.

And then its on to the Reserve Bank of New Zealand. No change to the cash rate target is the wide expectation. there are some expectations that guidance could ease a little more dovish, laying the foundations for a rate cut in perhaps early 2025 … perhaps being the crucial word there. There is still work to be done bringing inflation in NZ down to target.

Previews:

- RBNZ policy meeting Wednesday – preview – “little change to the neutral guidance”

- New Zealand – RBNZ shadow board recommends the Reserve Bank keeps OCR at 5.5% on Wednesda

- RBNZ Monetary Policy Review due Wednesday – “not expecting a whole lot”

- Reserve Bank of New Zealand policy meeting this week – preview (on hold widely expected)

- Reserve Bank of New Zealand policy meeting – rates to be left on hold

This snapshot from the ForexLive economic data calendar, access it here.

The times in the left-most column are GMT.

The numbers in the right-most column are the ‘prior’ (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.

This article was written by Eamonn Sheridan at www.forexlive.com.

Source link