Ya’ll finished with the FOMC dots and such? I can’t promise you so much excitement from the Asian time zone! What we do have is the Australian May employment report, which will be eyed by the Reserve Bank of Australia. The Bank is holding its cash rate at its high and seems inclined to do so through the whole of this year, I’m with ANZ on this:

- Australia’s ANZ forecast the first RBA rate cut in February 2025 (from November 2024)

The Bank is not inclined to raise the cash rate again as it wants to preserve the gains seen in the jobs market, with the unemployment rate only recently rising from five decade lows. Having said this, officials at the Bank have said they’ll hike if needed.

The jobs report today is expected to show employment gains and a slight fall in the jobless rate.

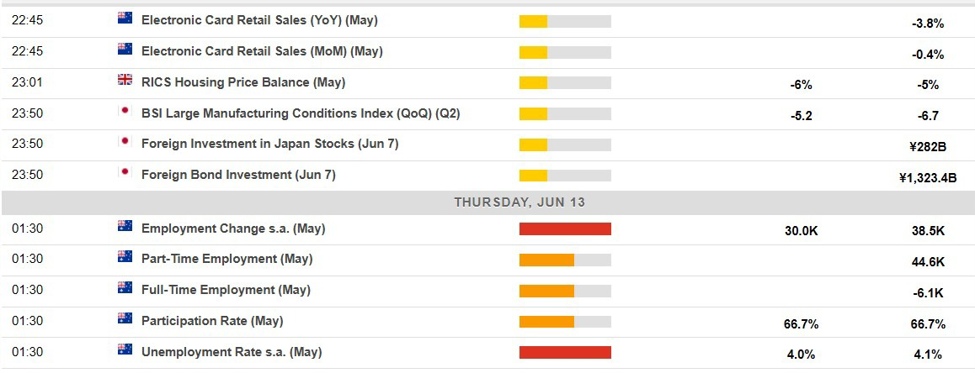

This snapshot from the ForexLive economic data calendar, access it here.

The times in the left-most column are GMT.

The numbers in the right-most column are the ‘prior’ (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.

This article was written by Eamonn Sheridan at www.forexlive.com.

Source link