It’s a packed data agenda ahead.

RBNZ Governor Orr kicks it off:

- to speak about the May Monetary Policy Statement to a business association meeting

I’m not sure he’ll be adding much to the extensive comments on the May decision he has already made.

Tokyo area inflation data follow soon after. Note the time on this is 2330 GMT (1930 US Eastern time), 20 minutes earlier than the usual time for Japanese data of 2350 GMT (1950), and easy to have it jump out unexpectedly (don’t ask me how I know this).

- National-level CPI data for this month will follow in about three weeks, it takes longer to gather and collate the national data.

- Tokyo CPI is a sub-index of the national CPI

- It measures the change in prices of goods and services in the Tokyo metropolitan area

- Its considered a leading indicator of national CPI trends because Tokyo is the largest city in Japan and is a major economic hub

- Historically, Tokyo CPI data has been just slightly higher than national Japan CPI data. The cost of living in Tokyo is a touch higher than in most other parts of Japan. Higher rents, for example

The other items of most focus are from China, the official PMIs for May. China has two primary Purchasing Managers’ Index (PMI) surveys – the official PMI released by the National Bureau of Statistics (NBS) and the Caixin China PMI published by the media company Caixin and research firm Markit / S&P Global.

- The official PMI survey covers large and state-owned companies, while the Caixin PMI survey covers small and medium-sized enterprises. As a result, the Caixin PMI is considered to be a more reliable indicator of the performance of China’s private sector.

- Another difference between the two surveys is their methodology. The Caixin PMI survey uses a broader sample of companies than the official survey.

- Despite these differences, the two surveys often provide similar readings on China’s manufacturing sector.

- The Caixin manufacturing PMI will follow on Monday, services on Wednesday

The PMIs today are expected to show some advance as China’s economy struggles off the canvas. The deeply troubled property sector is still a formidable foe to improvement though.

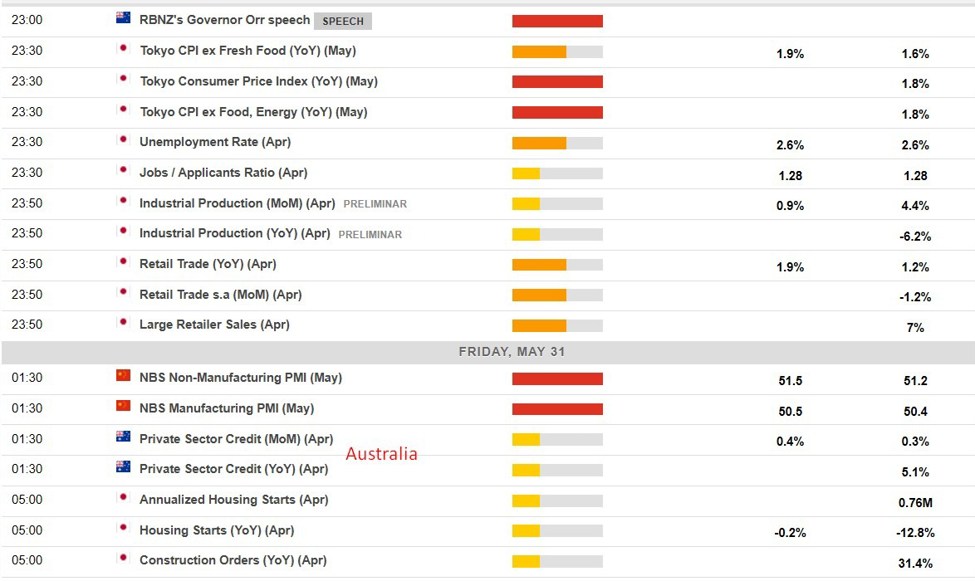

- This snapshot from the ForexLive economic data calendar, access it here.

- The times in the left-most column are GMT.

- The numbers in the right-most column are the ‘prior’ (previous month/quarter as the case may be) result. The number in the column next to that, where there is a number, is the consensus median expected.

- I’ve noted data for Australia with text as the similarity of the little flag with New Zealand can sometimes be confusing.

This article was written by Eamonn Sheridan at www.forexlive.com.

Source link