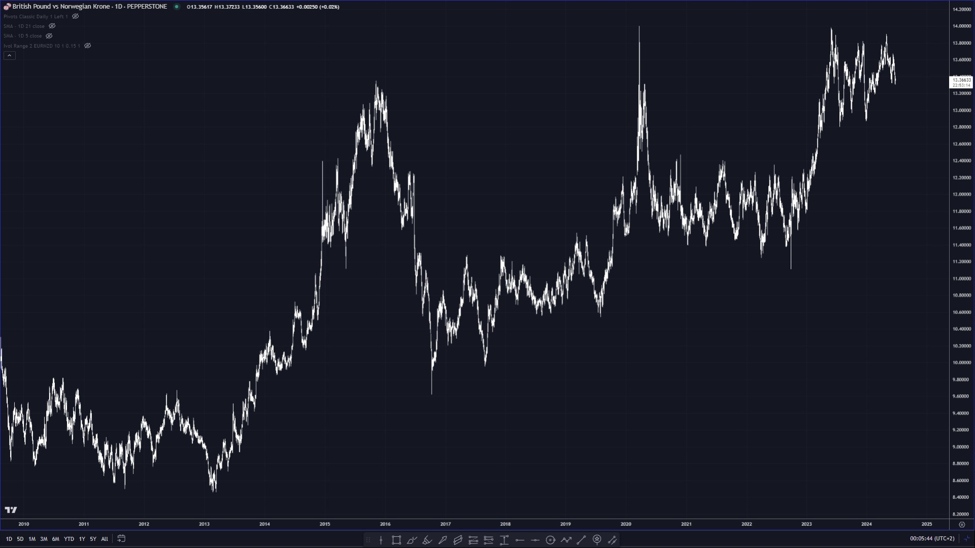

- Rationale for long NOK: The Norges Bank is one of the last central banks likely to cut rates. The bank’s decision to keep rates on hold, coupled with elevated inflation expectations and wage growth, suggests a hawkish stance. The NOK is considered extremely undervalued, and the Norges Bank’s preference for a higher exchange rate to combat imported inflation supports a long NOK position.

- Rationale for short GBP: The language from the Bank of England showed a dovish bias last week, discussing potential rate cuts despite sticky core inflation. The report suggests that a late summer rate cut is likely. The GBP is seen as vulnerable due to high inflation and potential rate cuts, making it a suitable candidate for short positions against the NOK.

Looks like a classic central bank policy divergence trade from BCA. As we noted yesterday, risk premiums do feel a bit low heading into the UK elections, so wouldn’t be surprised to see some downside playing out for Sterling.

This article was written by Arno V Venter at www.forexlive.com.

Source link